In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a debt and […]

Tag Archives: collection

In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a debt and […]

In 2023 it was reported that over 30% of Americans have an account that has recently gone to collections and that the average debt per person is a little over $9,000. Normally, when you hear that an account has gone to collections, you expect phone calls from unknown numbers asking to settle a […]

How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

Credit and Collections There are many misconceptions about how a collection could impact a credit score. Often times we have clients that think their scores should be higher and have collection companies calling and breathing down their back about paying a collection. They may even promise that if the collection is paid, it will help […]

Your past financial decisions may feel like they are coming back to haunt you, and handling the complications that arise from having a less than perfect credit score can be rather stressful. Dealing with your past credit mistakes can leave you feeling extremely frustrated and hopeless, but the good there is re-establishing a good credit […]

Are you being sued by a debt buyer? If you have, you’re not alone. Our office has seen a significant increase in clients coming in with lawsuits from debt buyers. What is a Debt Buyer A debt buyer is a company that purchases delinquent debt from original banks and credit card companies, these companies then […]

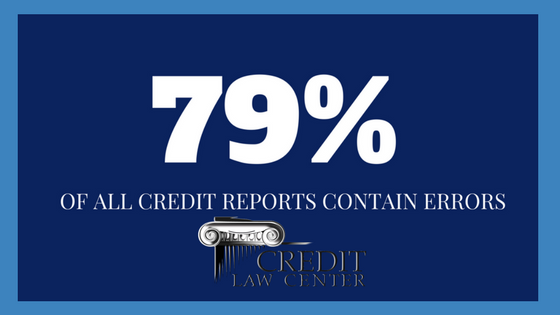

Hard to believe that 79% of all credit reports contain errors, but according to the FTC it is true. I know you are thinking!!!! How many of us would still be employed if we even made half the mistakes as the credit reporting agencies do on a consumers report? So… When was the last time […]

A credit report is a detailed compilation of information about the way you handle your debt, which is managed by businesses known as credit reporting agencies. In the United States, we have three major credit reporting agencies Equifax, Experian, and Transunion. All three credit reporting agencies collect your detailed information from lenders to create a […]