How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Tag Archives: kansas city

The Elephant in the Room The issue to which everyone is aware, but few want to talk about-credit repair companies. When you hear credit repair, what pops into your mind? You may have immediately rolled your eyes and scoffed at the phrase “credit repair!” Hey, we get it! You may be picturing someone holed up […]

5 Myths On Credit and Divorce Making the decision to end a relationship with a loved one can be one of the toughest calls to make in a person’s life. If you are considering divorce, what is not working is outweighing what is. Whether you are waiting for your spouse to pull the trigger because […]

Credit Scores That Are Merry And Bright Tis the season for gift giving-which means plenty of shopping! This is also the time when the season can cause a huge strain on your credit if you are not careful. Here are some tips to avoid the credit blues once the new year arrives. Avoid […]

The winds come whipping in, the sky turns black and-BOOM-a tornado blew through all of your life plans! Are you feeling as if Oz himself is behind the curtain pulling random numbers from the debris and tossing them out one by one? After the dust has settled you see a score that makes no sense, […]

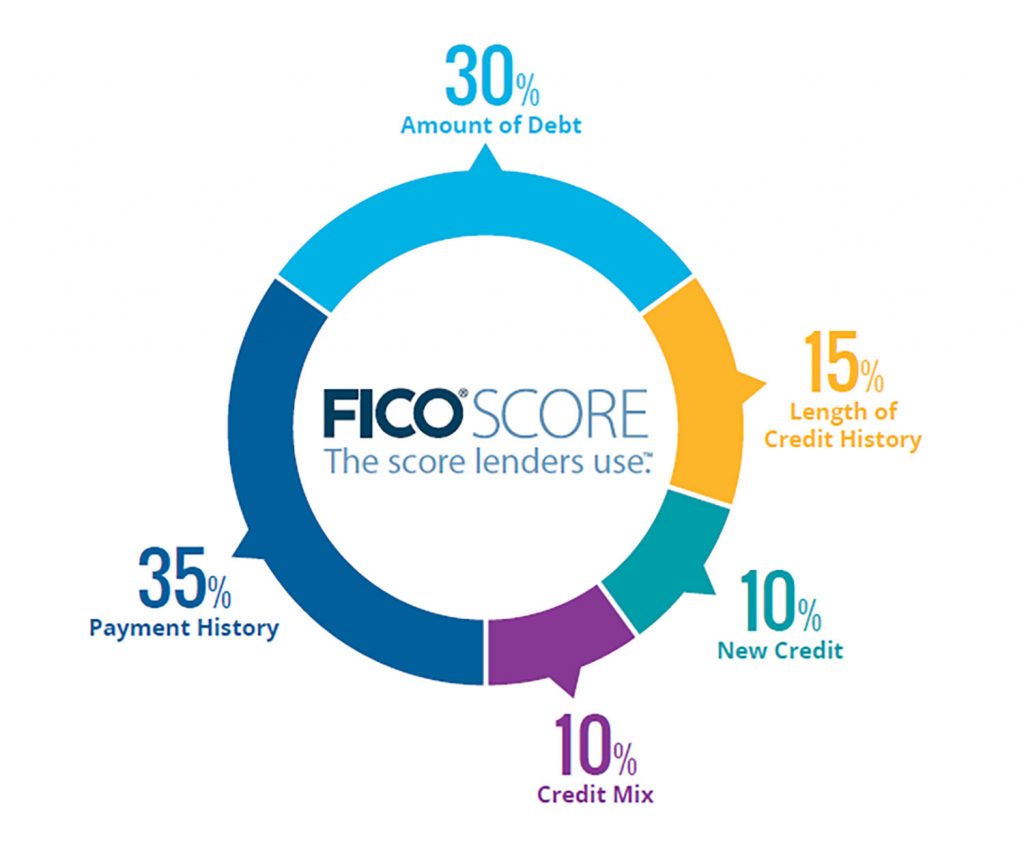

Are free credit scores a waste of your time? Last week, 2 of the big 3 credit bureaus were ordered to pay $23 million for deceiving customers. The CFPB accused the credit bureaus of misleading marketing of false information of credit scores and products being sold to the public. According to the regulator, “TransUnion and Equifax […]

2 of the big 3 credit bureaus busted for deceptive marketing – Credit Law Center The Consumer Financial Protection Bureau bust 2 out of the 3 major credit reporting bureaus due to the marketing of their over-priced, under-performing credit monitoring subscription products. Combined fines and consumer restitution total $23 million. CFPB will more than likely […]

Self Credit Repair – Credit Law Center What is self credit repair? Sounds like a silly question but this industry can be confusing to consumers. The credit reporting agencies only want self credit repair because When considering self credit asks yourself a couple of questions; do you change your own oil? Do you do your […]

What Bad Credit Really Cost You – Credit Law Center In today’s economy a good credit score is a must. Some consumers don’t realize how much of an impact a bad credit is score can have on their financial picture. Did you realize that a low credit score can impact how much you pay for […]

Giving thanks on Thanksgiving – Credit Law Center Tis the season to give thanks. Credit Law Center would like to thank every client that believed in us, to help them with getting back on track. Whether it be stopping debt collectors from harassing you, improving your credit score to buy a house or automobile, or […]