Debt is the amount of money borrowed by one party from another. Consumers typically borrow money from credit card companies or private loans for purchases that they may not be able to afford upfront. Debts are acquired from a car loan, credit card, personal loan or even student loans. In June 2017, U.S. consumer debt […]

Yearly Archives: 2017

Your past financial decisions may feel like they are coming back to haunt you, and handling the complications that arise from having a less than perfect credit score can be rather stressful. Dealing with your past credit mistakes can leave you feeling extremely frustrated and hopeless, but the good there is re-establishing a good credit […]

Are you being sued by a debt buyer? If you have, you’re not alone. Our office has seen a significant increase in clients coming in with lawsuits from debt buyers. What is a Debt Buyer A debt buyer is a company that purchases delinquent debt from original banks and credit card companies, these companies then […]

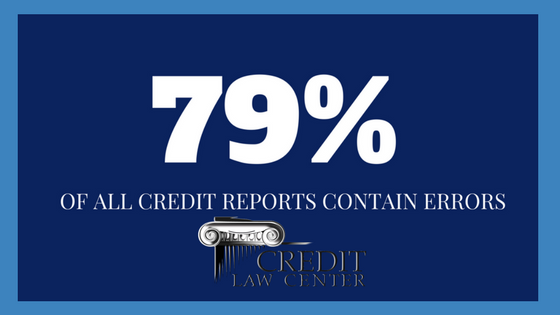

Hard to believe that 79% of all credit reports contain errors, but according to the FTC it is true. I know you are thinking!!!! How many of us would still be employed if we even made half the mistakes as the credit reporting agencies do on a consumers report? So… When was the last time […]

A credit report is a detailed compilation of information about the way you handle your debt, which is managed by businesses known as credit reporting agencies. In the United States, we have three major credit reporting agencies Equifax, Experian, and Transunion. All three credit reporting agencies collect your detailed information from lenders to create a […]

Buying a home can be one of the biggest decisions you will ever make. Once you have decided to take the plunge and buy a home, there are some things you may want to avoid during the process. We have created a list of the 5 Do’s and Don’t of buying a home. 5 Do’s […]

Trying to find a place to rent when you have less than stellar credit can leave you feeling hopeless. Finding a landlord that is willing to work with your situation may be a hefty task, but an important piece to this puzzle is knowing the red flags when it comes to rental scams. Scam artists […]

Establishing good credit in this day and age plays a significant role in becoming financially secure. However, there are still 26 million Americans that are still “credit invisible” under the traditional FICO scoring model.If you are one of the 26 million Americans that are “credit invisible” you may already know the challenges that this credit […]

Carrying credit card debt isn’t uncommon for Americans, according to a recent report by ValuePenguin, Inc 38.1% of Americans carry some credit card balance. When it comes to paying off credit card debt, one recurrent question is how to pay it off the faster. Every household has their unique financial situation and personal goal, so […]

College Students all over the country are preparing to head to campus for their first semester. For many new college students, this will be the first time that they will be able to spread their wings, as well as their first shot at financial freedom. Children of any age rely on their parents for guidance […]