Understanding Your Credit Score

Credit has become so essential to most big purchases you as a consumer will have to make, and that can be scary if you do not know how credit works. Credit can be confusing, but the more you can learn and utilize your credit effectively, the better off you will be in your financial future.

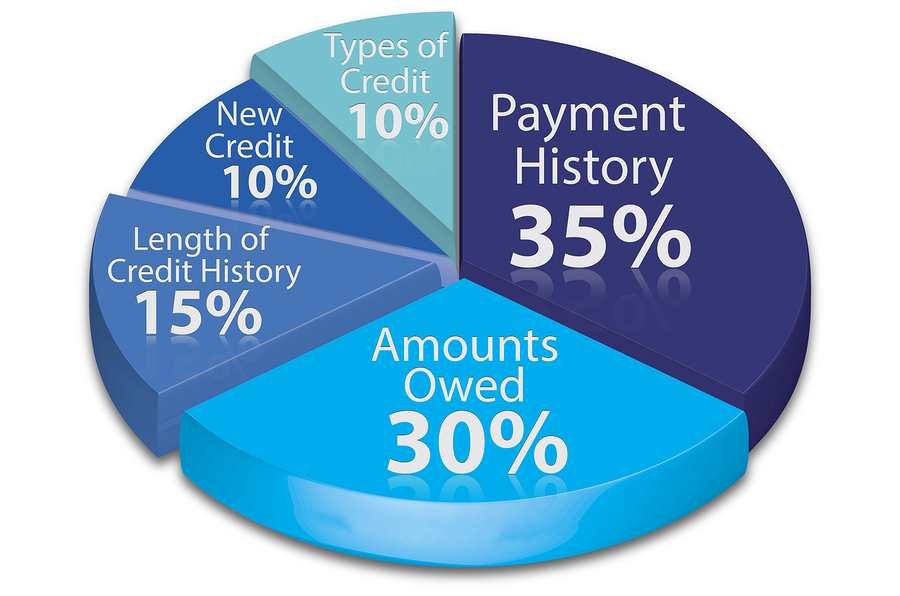

A credit score above 700 is typically considered good, and if it is above 750 then that is excellent. 800 is typically the highest and 350 the lowest on most credit scales. This score is determined through 5 different factors:

- Payment History: Late payments will lower your credit score.

- Amount Owed: If you have a high credit utilization ratio, then your score will be lower.

- Length of Your Credit History: The longer you exemplify responsible financial behavior, the better your score will be. On average, most people in the excellent credit category have a credit history exceeding 7 years.

- Your Credit Mix: Having a diversified credit portfolio including multiple different types of credit should help increase your credit score.

- New Credit: The more often you apply for credit, the worse your score will be. Opening new accounts also lowers the average length of your credit history, which effects factor 3 on this list.

Other Possible Influences on Your Credit Score

Joint accounts can affect your individual credit score. So, a late payment by either party included in the joint account can hurt both people’s credit.

Student loans are also dangerous for young people who do not know how to manage their credit year. Making sure to make these payments on time can be very beneficial to a student’s financial wellbeing in the future.

Raising Your Credit Score

Bad credit can seem scary and overwhelming, but it is not irreversible. Through responsible financial behavior and potentially the help from credit repair companies, you can raise your score to a level you will be proud of. Keeping an eye on your credit and just being mindful of your financial habits can go a long way in raising your score.

Fun Facts About Your Credit

Knowing as much as you can about credit and credit scores in general can actually be very beneficial to your everyday life. Although dealing with credit may not always be the most fun activity, impressing people with all of the knowledge you have about credit might be slightly more entertaining. So, here are some “fun facts” about credit you probably did not know before!

- Around 40 percent of United States consumers have applied for new credit a minimum of one time this year. Obtaining new credit does make up 10 percent of your credit score too.

- Minnesota has the highest average FiCO credit score in comparison to the rest of the states in the United States at 728. Some may argue that this is because of their conservative debt managing strategy, their booming Twin Cities economy, their low natural rate of unemployment, or their low cost of living.

- The average FICO credit score in the United States is 704, which is actually not a bad score. Keeping your credit score above average will make you stand out more, though, when applying for credit. There are ways to get it up too if your score falls somewhere below the national average.

- Keeping your credit utilization ratio low is very important when it comes to keeping a good credit score, which is why consumers with scores about 785 use only about 7 percent of their credit. The lower that percentage, the better your score.

- On average, American consumers have about 14 credit accounts open and about 5 credit cards reported on their credit report. As long as payments are all made on time, there is nothing to worry about here.

- The top 1 percent of consumer credit would be those consumers with scores of 850. You do not have to keep your credit score this high to be considered a responsible consumer, though. Scores ranging between 670 and 739 are also considered good.

- FICO scores are what are checked most commonly by lenders with a usage rate of over 90 percent.

- Poor credit scores would be those falling below 580. Only about 16 percent of American consumers fall into this group.

- Fair credit scores range between 580 and 669. About 17 percent of the population would fall into this category.

- Good credit scores would range between 670 and 739. 24 percent of the population would be considered to have good credit.

- Very good credit scores would range from 740 to 799. About 23 percent of the American population falls into this range.

- Finally, Exceptional credit scores would be considered over 800. About 20 percent of the population falls into this category of people.

Article by Joe Peters

Do you have questions about your credit report? If you would like to speak with one of our attorneys or credit advisors and complete a free consultation please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.