Good, Better, Best and Bad

The internet and cell phones have now made it easier than ever to check your credit score as often as you’d like. Millennials are starting to check their credit scores more frequently than any other generation. This could be due to the fact that credit has become vital in many aspects of life. Whether you want to buy a house, car, or take out a loan, you can expect that your credit report will be scrutinized. Do you know what you are looking at when it comes to those numbers?

A Numbers Game

Your credit score is ever changing. While you may not suspect that things are moving and shifting, they are. Often times people think of their scores as either really bad or good enough. When you are browsing the internet and you start to check your credit scores, please take note that you are looking at a consumer score.

What is a consumer score? This is the scores you have access to online that may show higher than what a lender or bank would pull for you. These are called vantage scores and are not your true FICO score. These scores show higher so that you will start shopping around for products, or continue to spend. Your score may be significantly lower when you apply for a home loan. Once you understand this, the frustration or mind game you feel that happens when your scores are so different won’t be so frustrating. You should pay closest attention to what a bank or lender tells you your score is. So, what are all these numbers really saying?

- Very Good : 740-799

- Good : 670-739

- Fair : 580-669

- Poor : 300-579

Having scores higher than 799 is possible to obtain but can be hard. A 670 and up is considered exceptional. The better the score, the better the interest rates, among other things. If you are below a 700, there is definitely some room for improvement!

Increasing Credit Scores

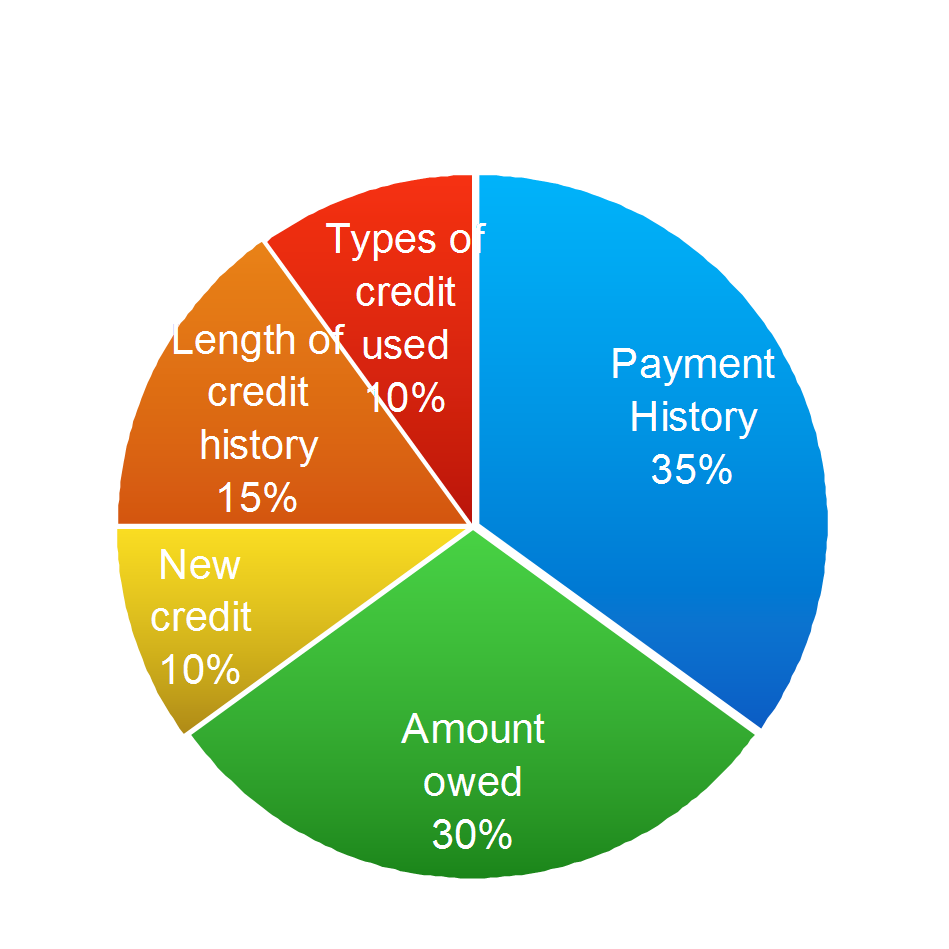

If you have a low FICO score, you can bet that is due to a combination of factors rather than just one culprit. A credit score is made up of many different factors. If you are thinking your credit is low due to just inquiries, you are probably incorrect. The chart below demonstrates the factors that come into play with your FICO.

Positive Payment History

The largest section of the pie chart is your payment history. If you have been behind on bills, have late payments or cannot keep up current credit cards, your score will be dramatically impacted.

One late payment can potentially drop your score 100 points.

If the creditor sends your card into collection or charge off, we can take a look at your report and discuss what the next options are for your credit report or how you can try to make up for those late pays in other ways to increase the scores. There is a method to the madness when it comes to your credit scores, you just have to know how to play the game.

Credit Scores and Savings

If you take a look at the numbers above and fall into the category of poor or fair credit, you may notice how much you are having to pay on your auto or home loan. When your credit score is low, you’ll notice how much higher your interest is on your payments. While it is great that you may be able to get approved for a car loan or auto loan with a lower score, you would be better off waiting until you can improve your credit scores. We want to help you save!

Financially speaking, if you can wait and try to get your scores back up you can be saving yourself a significant amount of money each month for your family.

Quick Ways To Improve

- Become an authorized user on family member or spouse’s card

- Look into a credit builder loan

- Apply for a secured credit card

- Invest in credit repair to get derogatory items removed

Your credit will be around for the rest of your days. While you may have made financial mistakes in the past, you can improve and learn from them. If you have found yourself in a huge hole, and have debt collectors and collection companies calling you daily, please get in touch with a company that can help you. At Credit Law Center we educate our clients on everything they may need to know, to continue to better their credit scores as well as represent them so that the calls can stop. We know the importance of great credit and what doors it can open when you reach that “very good” zone.

Open new doors today for your family, and invest in your financial future.

Do you have questions about your credit report? If you would like to speak with one of our attorneys or credit advisors and complete a free consultation please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.