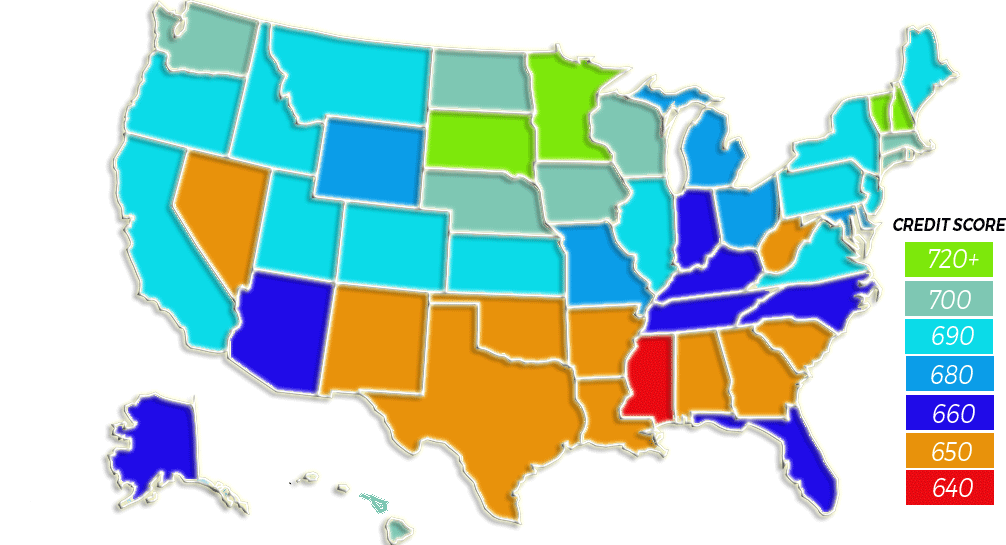

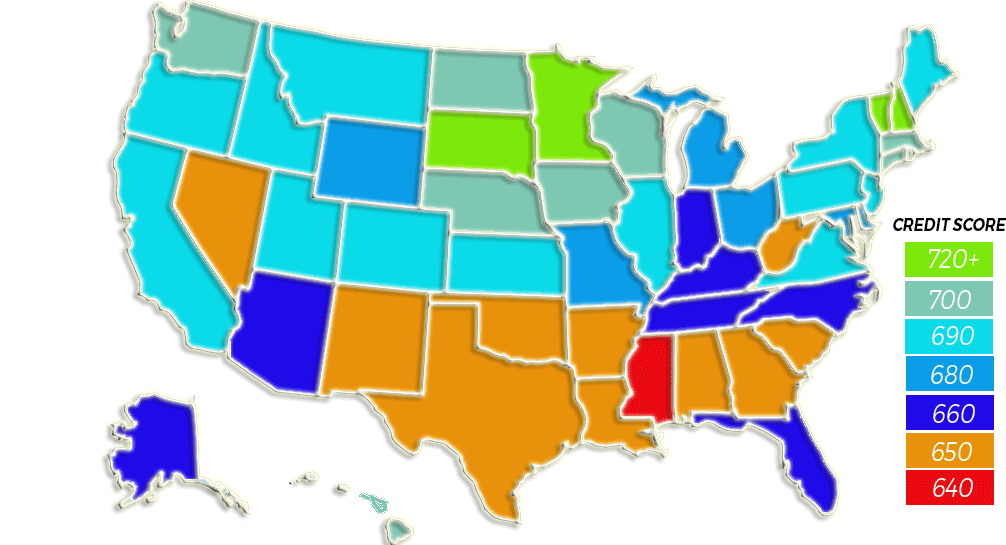

Battle of the States

Have you ever wondered what part of the United States has the best/worst credit scores? It may come as a surprise to you but, the highest scoring state, Minnesota has an average credit score of 709. What may come as even more of a shock is that yes, they do have credit cards! On average, folks in Minnesota have 2.9 credit cards with an average balance of $5,911. You read that right! The take away from these numbers is that yes you can have great credit, while using and maximizing the credit cards you do have to obtain great credit scores.

We do not condone racking up credit cards by any means but there are several misconceptions out there about how one obtains good credit. Unfortunately, there is no snap of the fingers to make scores jump 100 points over night but we do know several tricks in an effort to get to the point that you may be trying to get to.

If you are looking for

- A home loan

- An auto loan

There are several factors that come into play with your credit. Many people do not even know or understand how a FICO score is made-

35% of your FICO is your payment history, 30% amount owed, 15% length of credit history, 10% new credit and the credit mix

So what is the trick?

Is there a trick to better credit scores?

Is there at trick to these high scores? One could argue that there are tricks to the trade.

Imperfect credit scores do not happen over night, the same goes for scores like people in Minnesota with 709. In order to obtain great credit scores you need to know what a good credit mix looks like. At Credit Law Center we advise that a consumer should have two great revolving credit cards and two installments. We also advise a few other steps in order to obtain great scores:

- Authorized user- a spouse or family member with a credit card with a low balance and several years of history is a great way to get a quick boost in scores

- Pay for deletion-asking a creditor/collector to remove an item from the report if you pay a certain amount

- Lower utilization-paying down a card more than the minimum payments will dramatically impact your credit

- Inquiries on your credit report can bring the score down

Your Next Step

If you have completed the above steps and don’t see a change in scores, you may have negative items on your report that are weighing heavily like collections, too new of credit cards, or something as significant as a bankruptcy, tax lien, or judgment. Have you looked at a credit report lately? We can go through the credit report with you and discuss what steps you may need to take in an attempt to maximize your efforts.

Did you know?

- It is actually better for our economy for consumers to have lower FICO Scores. The higher the interest rates, the more money circulating through the economy as well as the increase in the value of currency.

- There is a misconception that you will have better credit if you do not use credit cards. That is inaccurate, as FICO needs you to have/use credit to have the ability to grade you to come up with your FICO score.

- Having only installment loans (auto, home, personal) and no credit cards, or only having credit cards, and no installment loans keeps your credit score down 10% then what it could be if you had a good credit mix.

Are you hoping to increase your credit scores and get on the track to better credit? Contact us today and one of our credit advisors will complete a free consultation or please give us a call at 1-800-994-3070 we would be happy to help.

A Note From The Author: The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.