Credit Scores Dropping

Have you noticed a random decrease in your credit scores recently? There are many factors that can cause your credit scores to fluctuate. Many consumers do not understand that a credit score has no memory and can change immediately due to activity or changes that can happen as soon as you make a payment or use a credit card.

Can I recover from a drop?

Do not panic. Your scores really do change so much, so there is no reason to worry unless you have done some significant damage to a report like went late on a payment. A few things to know ahead of time, prior to calling your credit card companies or bank about your report-

- If you are pulling credit scores on consumer sites like Identity IQ or Credit Karma, you are looking at consumer scores or vantage scores. These are not your FICO scores. These scores are more of a suggestion of what is going on but not always right or exact.

- If you want to know your true FICO scores, the only place you can get the real FICO score is an actual lender or banking institution.

- There are 56 different versions of FICO. Your home loan is going to be using a different version of FICO than the dealership that ran your credit. Don’t expect to see the same scores because they will be off.

What Do Inquiries Do To My Credit?

Your scores can be decreasing due to one too many inquiries on your credit report. A good rule of thumb is to only inquire about 10 times for every 12 month period. Once you start shopping around for vehicles or homes and having your credit pulled more than the suggested number, you will start to notice your scores dropping.

How Does A Late Payment Hurt My Credit?

Unfortunately, late payments have a dramatic impact on your credit scores. This is the hardest thing to get removed from a credit report but we still try to go after late payments and try to get them removed.

These late pays can potentially drop your score 100 points.

If the creditor sends your card into collection or charge off, we can take a look at your report and discuss what the next options are for your credit report or how you can try to make up for those late pays in other ways to increase the scores.

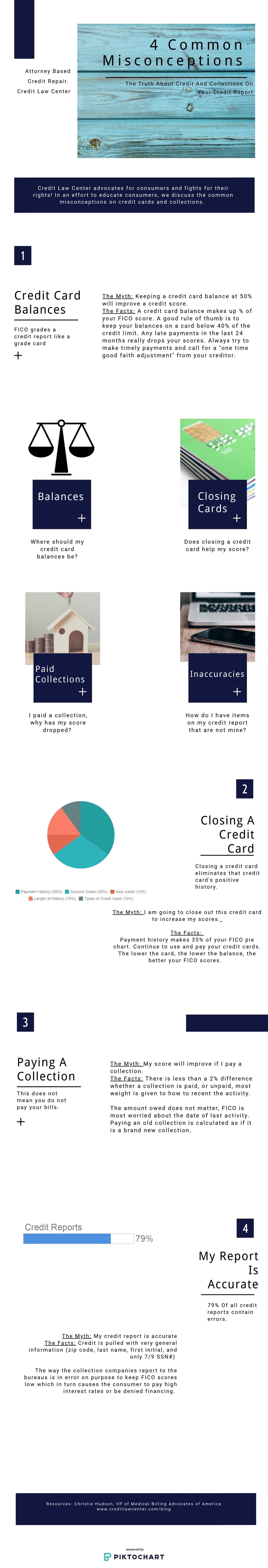

What If I Don’t Have Any Credit?

Not having any credit cards or installment loans will also keep you at low scores. In order to have good credit scores, FICO has to have something to grade you on. We advise 2 credit cards and 2 installment loans (auto, home or personal). There is a misconception that no credit keeps you from having bad credit. That is not true and in order to qualify for a car loan or auto loan, if you are not showing that you can make payments on time and be trusted with a loan, a lender doesn’t know how trustworthy you are to loan to. If you are hoping to get a loan, it is important to start establishing credit for at least 6 months to a year and build and show positive payment history. If you are in credit repair and have noticed that your scores are dropping but derogatory items are falling off, it may be due to the lack of credit you have established, or that the credit you do have is not being utilized the right way i.e. high card balances above 30% utilization or recent late payments which will keep your scores down.

Factors Causing A Drop

- Late payments

- High Balances

- Too many Inquiries

- Late reporting (possibly your credit cards reporting at different times to the credit bureaus. An easy fix to this is call your credit card and ask them when they report to the bureaus so you know when to make payments so your score reflects better)

- Paying an old collection (there is less than a 2% difference whether a collection is paid or unpaid, most weight is given to how recent the activity)

How Can I Start Building Credit?

- Become an authorized user on family member or spouse’s card

- Look into a credit builder loan

- Apply for a secured credit card

- Invest in credit repair to get derogatory items removed

Above all, be patient. Building and establishing credit takes time. If you are thinking about buying a home or vehicle, start planning ahead and looking at your credit now. Credit impacts many factors like interest rates, your insurance and many other things. Great scores mean more savings in your pocket!

A Note From The Author: The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.

Article by Breana Washington

Do you have questions about your credit report? If you would like to speak with one of our attorneys or credit advisors and complete a free consultation please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.