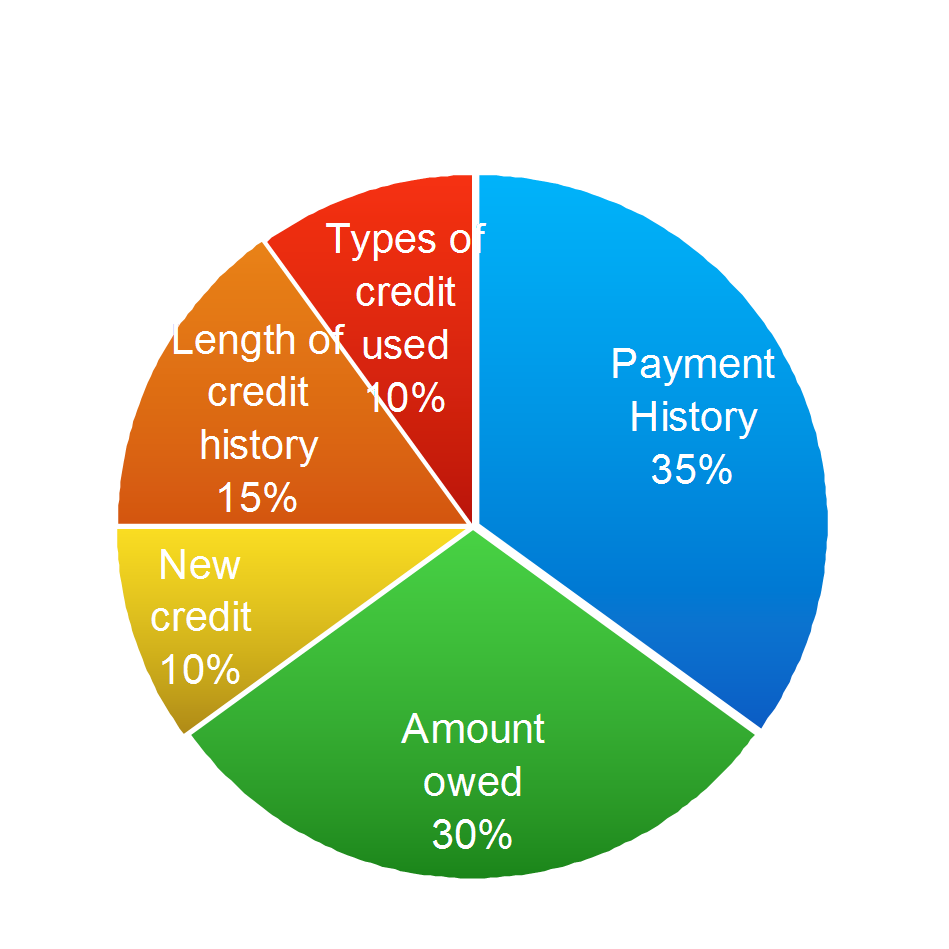

The largest factor on your credit report is your payment history. Late payments are huge when it comes to dropping the credit scores. At any given time, always try to make at least the minimum payment on your loans.

Saving Money Starts Here

Whether you are looking to get into a new home or buy a new car, your credit scores are vital. If you are hoping to make changes for your financial future, you can start taking small steps now to get back on the right path. If you are in need of assistance today, our credit advisors can help educate you on what you can be doing on your end while we work on derogatory items on the credit report that are hindering you from higher scores.

A Note From The Author: The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.