Credit Law Center / Credit Protection USA NEW CRM Preview

Credit Law Center / Credit Protection USA NEW CRM Preview

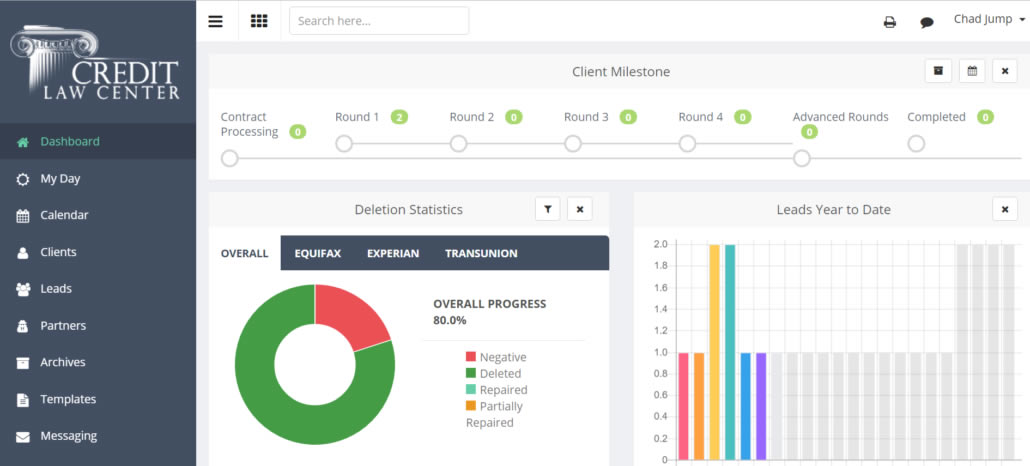

As we turn the page on 2016 and ramp up for 2017, Credit Law Center / Credit Protection USA is almost ready to release their very own credit CRM to market in 2017. Credit Law Center has specialized in credit repair for over 7 years and has out grown all current available credit repair software. So although Credit Law Center / Credit Protection USA is not known as a software company, they have invested in building a software that can keep both their staff, mortgage lenders and automotive dealers, informed on where their customers are in the credit repair process.

This is the first software of its kind, that will be mortgage lender and dealer facing. Wouldn’t it be nice to know when you have a customer ready to reapply for an approval, once their credit score has changed to the appropriate score? Better yet, what if the customers credit score didn’t change but Credit Law Center was able to get some judgments, collections or repos off the customers credit and now you have a buyer? That is exactly what this software is designed to do.

It also is designed to provide custom reporting in order to provide detailed ROI reports that will show you customers that were once marked bad originally, now marked good and ready to reapply. So for an automotive dealer that spent $6000 a month on Autotrader.com leads and half of their leads be marked bad, usually would show not much return on your investment. What if I told you we can turn some of those bad leads into good leads and re-coop some of that money back for you? That is exactly the goal in which Credit Law Center / Credit Protection USA has in mind for 2017.

Put the NEW CRM with a proven sales process model and you have a recipe for success. You are making money, while helping people get their life back on track. It is a win for both the consumer and the mortgage lender and dealership. You are changing the subprime buying cycle forever.