2. Find The Right Fit For You

If there is an absolute need for a credit card as a student, you want to be sure to do all research before taking the next step and signing up.

When you are looking into applying for a credit card remember these few rules

- Shop for low rates

- Try a credit union

- If you apply for a checking or savings account with a bank, look into credit card options with them as well

3. How To Use The Cards You Get

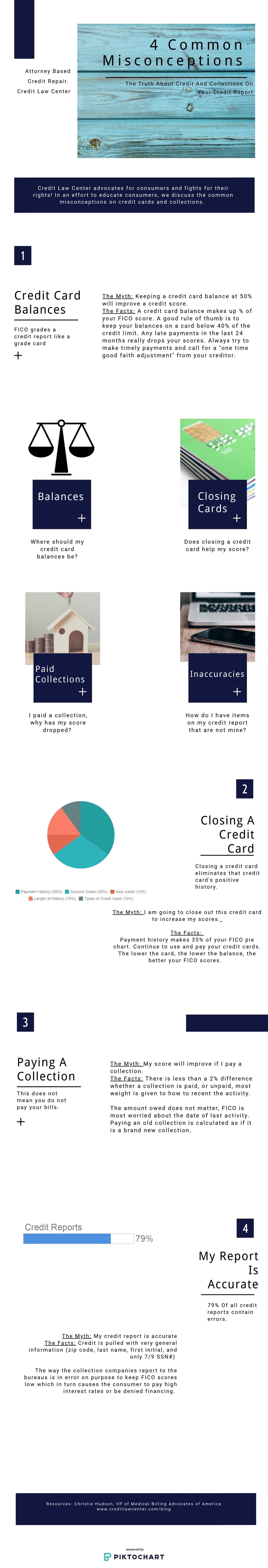

A credit card should only be for emergency use or to build credit. Students should keep credit card balances as low as possible. If they are using the credit card, try to keep the balance below 30% of the limit.

Credit card balances are reported to the credit bureaus each month. Your credit score will reflect lower scores, if your balances are very high or are reaching maxed out or close to the limit.

4. Building Credit

If your student is using credit cards, encourage them to monitor their credit.

The myth out there about having to keep a balance on your credit cards is not accurate. Remind your student as well, that most of the credit cards will be acquiring interest.

There are many companies out there that will offer credit reports for free or you can enroll in credit monitoring.

When pulling a credit report, take note that any consumer score that you can view online is a vantage score not an actual FICO score. Vantage scores tend to be higher than what an actual FICO is. FICO scores can only be given to you by a bank or lender. However, monitoring your credit at this time is more about what is showing on the report and the timely payments, etc on the report rather than the bureau scores.

5. Put A Lid On It

In an era where it seems there are so many awesome things going on whether you are on Facebook or Instagram, it can be hard to miss out on fun opportunities that maybe you just cannot afford.

Although your student may want to take that awesome Spring Break trip with friends or they have a hard time without the newest clothes, continue to help guide them and help them understand the importance of making good financial decisions.

How Can My Student Start Building Credit?

- Become an authorized user on family member card

- Look into a credit builder loan

- Apply for a secured credit card