The cost of bad credit can be very expensive. It can lead to higher interest rates on loans, higher insurance premiums, difficulty getting approved for housing, and difficulty getting approved for employment. The cost of bad credit can range from hundreds to thousands of dollars depending on the severity of the credit situation. The fastest […]

Category Archives: Debt

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

The name is frightening. As it should be. The practice of trying to collect on Zombie Mortgages can be just as frightening. So, what is a Zombie Mortgage or a Zombie debt? Well, it’s debt that is past the statute of limitations and cannot be used as weapon to bring a consumer to court to […]

When looking at a credit report, many folks will see collections and charge offs. What’s the difference? Simply put, a Charge Off is a term a lender will use when the consumer has not made the contractually agreed payments. The lender has tried repeatedly to contact the consumer for re-payment with no response. So, the […]

What is a credit score? Most people would answer that this is how lenders see if you are able to receive a loan and at what interest rate. And that’s true. But really, it’s an algorithmic number telling a lender how likely a person is to default on a loan within the first 24 months. […]

Most all of us have heard of Debt consolidation. But is Debt Consolidation right for you? What type of debt consolidation should one choose? Is Debt Consolidation effective? What are some of the pitfalls of debt consolidation? Guess what, sometimes “life” happens and we need to utilize our credit cards out of necessity. A perfect […]

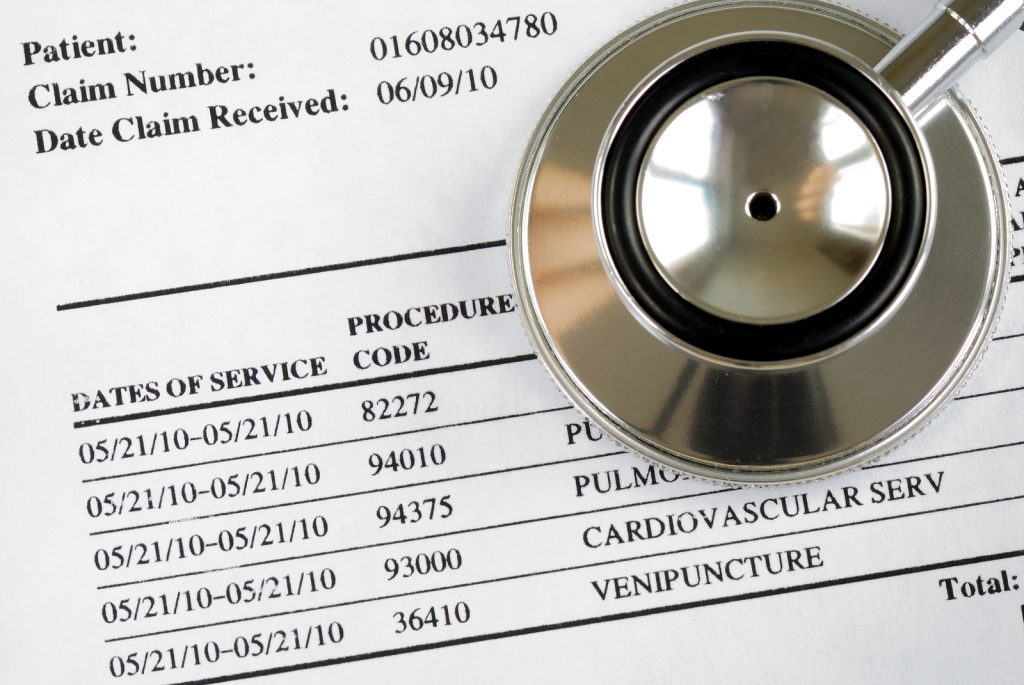

As of July 1st, 2022 all medical debts that have been paid, whether the debt was held by a physician or a collection agency, must be suppressed from a consumer’s credit report! This was announced by all three CEO’s of Equifax, Experian and TransUnion in April of 2022. Now before we start patting these CEO’s […]

Since the beginning of the pandemic, the amount of debt held per average American citizen has increased exponentially. With more debtors comes more collectors looking for new ways to track down those who owe them money. With the implementation of new collection rules, debt collectors have new means of chasing down debtors outside of mail […]

What is Considered Medical Debt With there being more than 45 different FICO scores in circulation there is bound to be some variances in how each score is reported. Each debt listed on a report holds different weight; from revolving debt to past due debt, each instance is judged differently across each scoring model when […]

Student loans seem to be on almost everyone’s credit reports. They can positively impact your credit scores if you are consistent with your payments and aware of what is happening with your loan. As with any bill or loan you take out, it is extremely important to your credit score as well because it can […]