The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

Tag Archives: Credit report

I remember sitting around a bonfire one cool autumn evening with a few close friends from high school. We had all gone our separate ways after graduation, some of us went to acquire our degrees immediately, others went off to the military and some went to trade schools to prepare themselves for an apprenticeship. As […]

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

Time to Pass Go: How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is going to […]

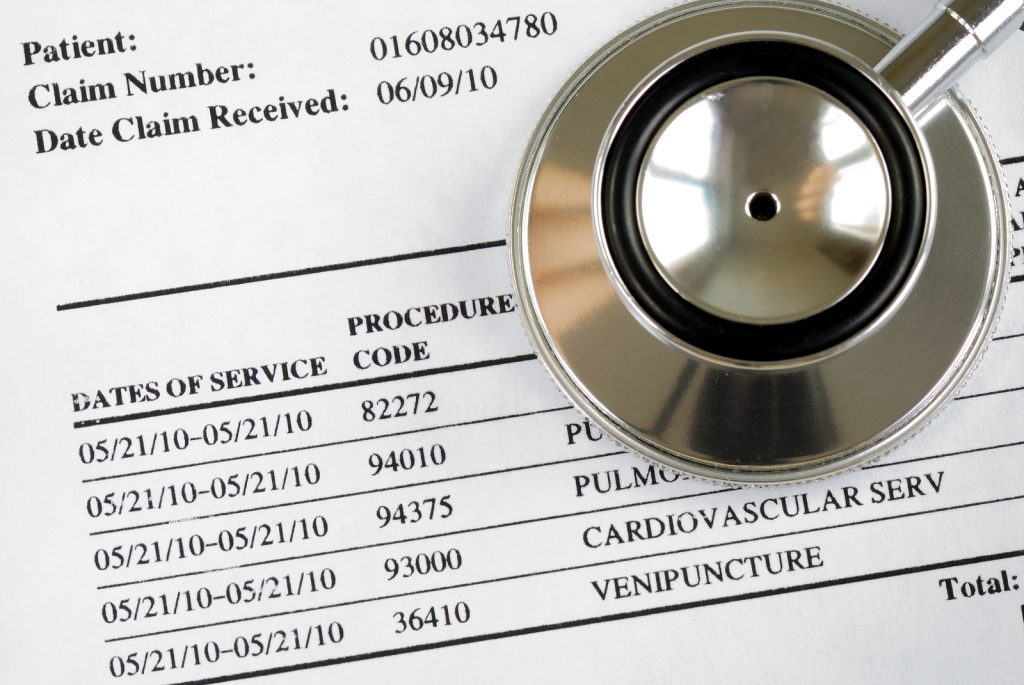

As of July 1st, 2022 all medical debts that have been paid, whether the debt was held by a physician or a collection agency, must be suppressed from a consumer’s credit report! This was announced by all three CEO’s of Equifax, Experian and TransUnion in April of 2022. Now before we start patting these CEO’s […]

I remember sitting around a bonfire one cool autumn evening with a few close friends from high school. We had all gone our separate ways after graduation, some of us went to acquire our degrees immediately, others went off to the military and some went to trade schools to prepare themselves for an apprenticeship. […]

Whether you are applying for a new credit card or a home loan, hard inquiries are constantly present when attempting to build credit. Although hard inquires are one of the most common items found on a credit report, there is still much mystery surrounding their effect on a credit score. In todays “Fact or Fiction” […]

Time to Pass Go: How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is going to […]

Time For A New Car? Several years ago when I was broken down on the side of the interstate in my 92 Jeep Cherokee I thought to myself “My next car is going to be brand new so I don’t have to deal with this gain!” I knew that I would need to finance as […]

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break your credit! […]