Your Fix of the Mix We all know the importance of having a good credit score.With a high credit score, you can open to door to better interest rates, loans, benefits and more! Good credit can be the deciding factor in whether or not you get approved to rent a home or get a particular […]

Tag Archives: Credit report

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

So You’re Saying There’s A Chance? All jokes aside, credit repair is a very serious matter. We have come into contact with many companies that over promise and under deliver when it comes to the services they offer. Have you been teetering back and forth between companies but have been unsure what to ask? Well […]

So You’re Saying There’s A Chance? All jokes aside, credit repair is a very serious matter. We have come into contact with many companies that over promise and under deliver when it comes to the services they offer. Have you been teetering back and forth between companies but have been unsure what to ask? Well […]

Is Rent-To-Own A Sure Thing? The here and now seems to take the front seat as opposed to decisions that are best for the budget for a lot of families. “We need more space.” “Our credit isn’t where it needs to be.” “What is the quickest way to start building for our future and not […]

Credit and Collections There are many misconceptions about how a collection could impact a credit score. Often times we have clients that think their scores should be higher and have collection companies calling and breathing down their back about paying a collection. They may even promise that if the collection is paid, it will help […]

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

Managing money can be challenging for most Americans, even in the best situations. For the 6.5 million people in the United States living with a developmental disability money, credit and debt create a unique concern. Developmental disability is a term used when a person has a specific limitation in cognitive functioning and skills, including communication, social […]

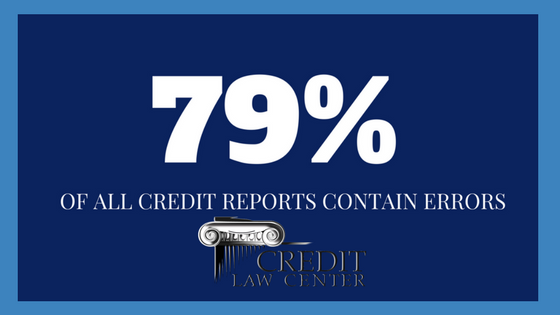

Hard to believe that 79% of all credit reports contain errors, but according to the FTC it is true. I know you are thinking!!!! How many of us would still be employed if we even made half the mistakes as the credit reporting agencies do on a consumers report? So… When was the last time […]