How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

Tag Archives: credit

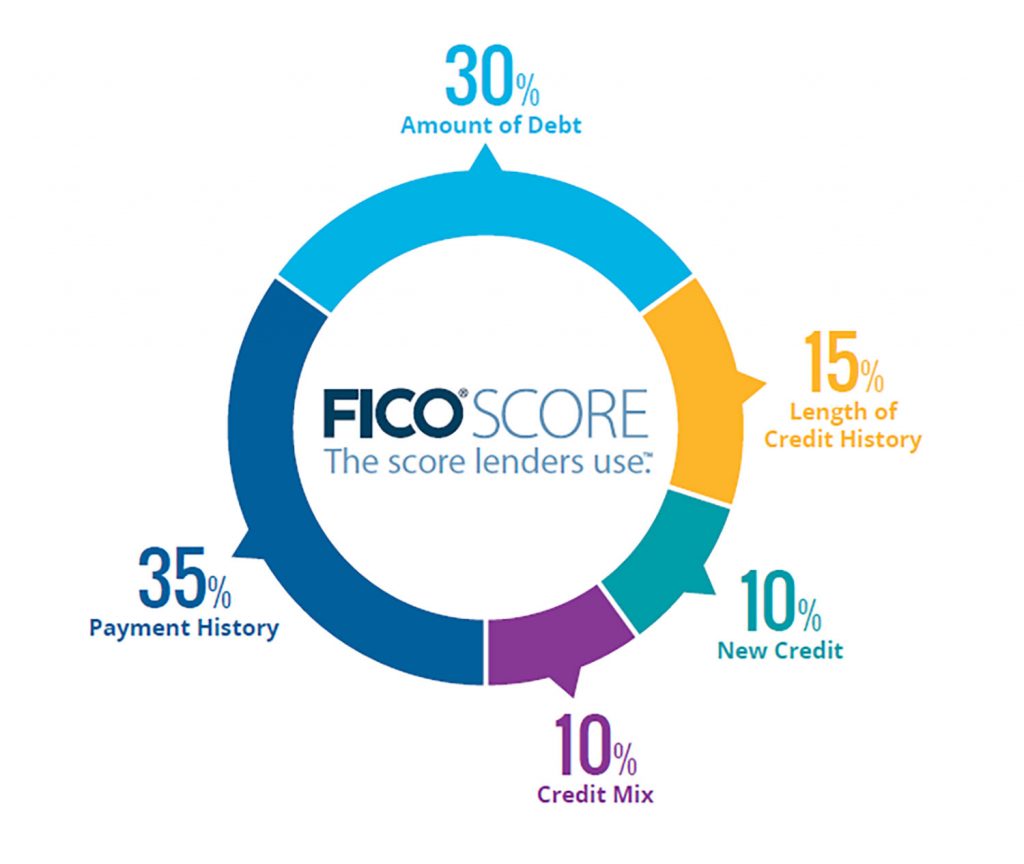

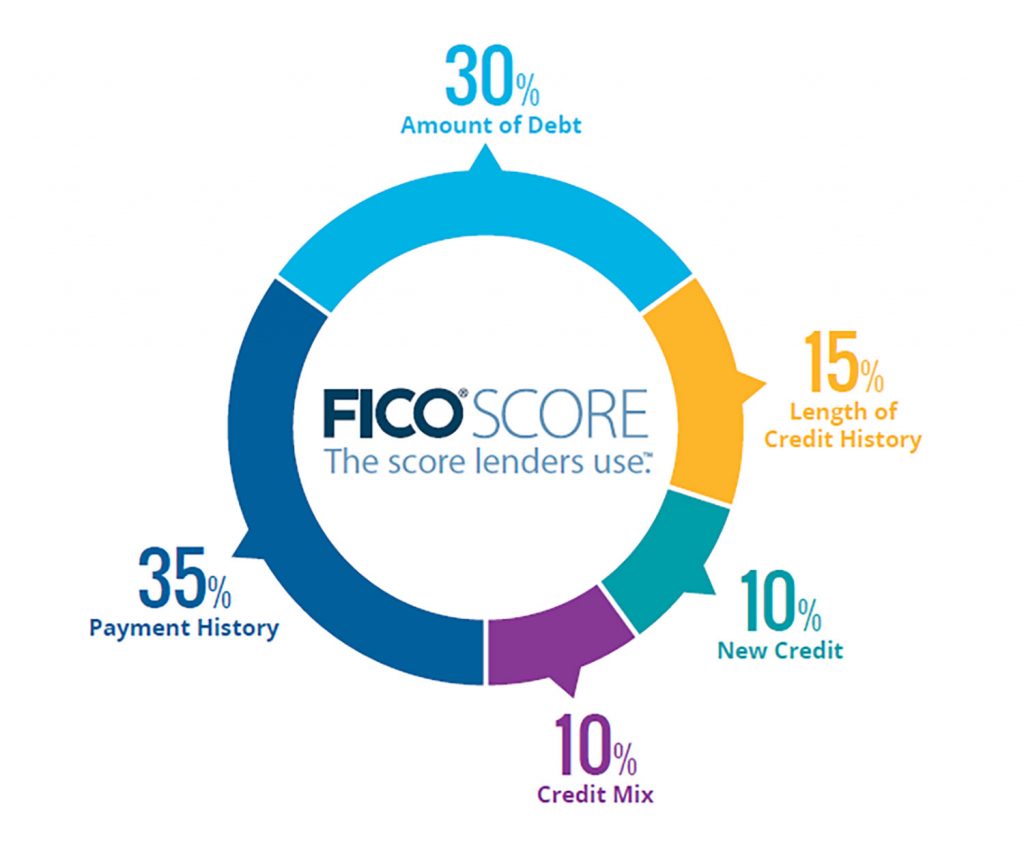

How Does A Decrease In Credit Limit Effect Me? Your credit utilization rate is one of the most important factors when it comes to your credit score. Depending on how much of the available balance you use will reflect what kind of borrower you are and can be the deciding factor in a substantial credit […]

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

Building Buying Power As the Spring months start peeking through, the home buying market is heating up! Have you been picturing the day when you can paint your own walls and mow your own grass? The dream of homeownership comes with great financial responsibility. Many first-time home buyers have questions about their down payment, and […]

Why choose a Law Firm for Credit Repair? The fact is, there are many Credit Repair Organizations operating in the US right now. There are many good companies out there that have the best interest for their clients at heart. Then again, there are many who don’t. To be perfectly honest, there is no reason […]

Buying your first home is a daunting milestone in everyones life and can bring both joy and anxiety when beginning the process. One large source of anxiety comes from the ever looming need of an acceptional credit score to aquire acceptable rates. For those that meet this criteria as displayed by your credit monitoring service; […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

Inboxes full of spam and junk mail, texts coming from unknown numbers alerting you to new investing opportunities, “urgent” mail with pre approved credit and loan offers, and new marketing practices are just some of the annoyances the average consumer must face on the daily. In todays blog, we will go over how to opt […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]