Many businesses have shut down during the coronavirus outbreak, and a lot of people are wondering how they will be able to pay their next, mortgage or credit card payments. This article will help guide you on what you can do and where you need to go to find some help. At the bottom […]

Monthly Archives: March 2020

Amidst the COVID-19 outbreak, Americans are struggling in more ways that one. With many people getting sick, countless workers being laid off or seeing their wages hit due to new restrictions and guidelines from social distancing, credit becomes the last thing on anyone’s mind! If you are one of the many Americans that are being […]

A Light in the Dark For all of those that have been financially impacted by COVID-19, below is a list of some of the largest lending institutions and banks that have already released statements and programs to help those affected. We have pulled this list together attempting to help you make the best decision to […]

Student Loans and Credit Scores Student loans seem to be on almost everyone’s credit reports. They can positively impact your credit scores if you are consistent with your payments and aware of what is happening with your loan. As with any bill or loan you take out, it is extremely important to your credit score […]

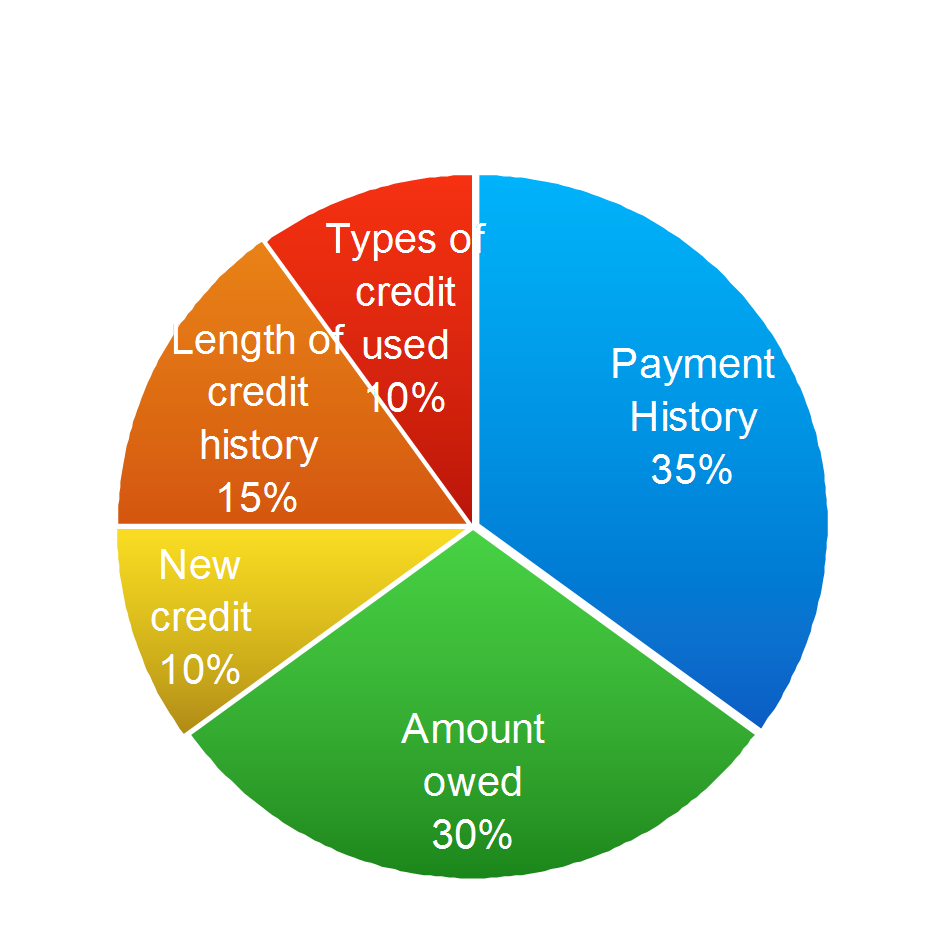

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break […]

The People Behind The Credit Score At Credit Law Center we fully believe in the people behind the credit scores. A company is only as good as its “Why” and what matters to us most, is our clients. We recognize that bad things happen to great people and wish to help improve individuals buying power, […]

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]