The simple answer according to FICO is 715. But average means different things when it comes to one’s age, where they live, and how much money they make. There are also so many scoring models out there, it’s hard to tell where one stands. One thing for certain is getting yourself in a position to […]

Tag Archives: FICO Score

On July 31st, 2023 a bi-partisan group of Congressional Representatives wrote to the Director of the Federal Housing Finance Agency, in essence, demanding that the FHFA keeps their deadline in the implementation of VantageScore 4.0 and FICO 10T for determining credit scoring factors in gaining a Home Mortgage Loan. FICO has been the standard bearer […]

The simple answer according to FICO is 715. But average means different things when it comes to one’s age, where they live, and how much money they make. There are also so many scoring models out there, it’s hard to tell where one stands. One thing for certain is getting yourself in a position to […]

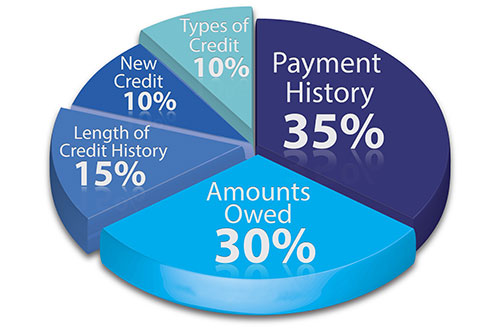

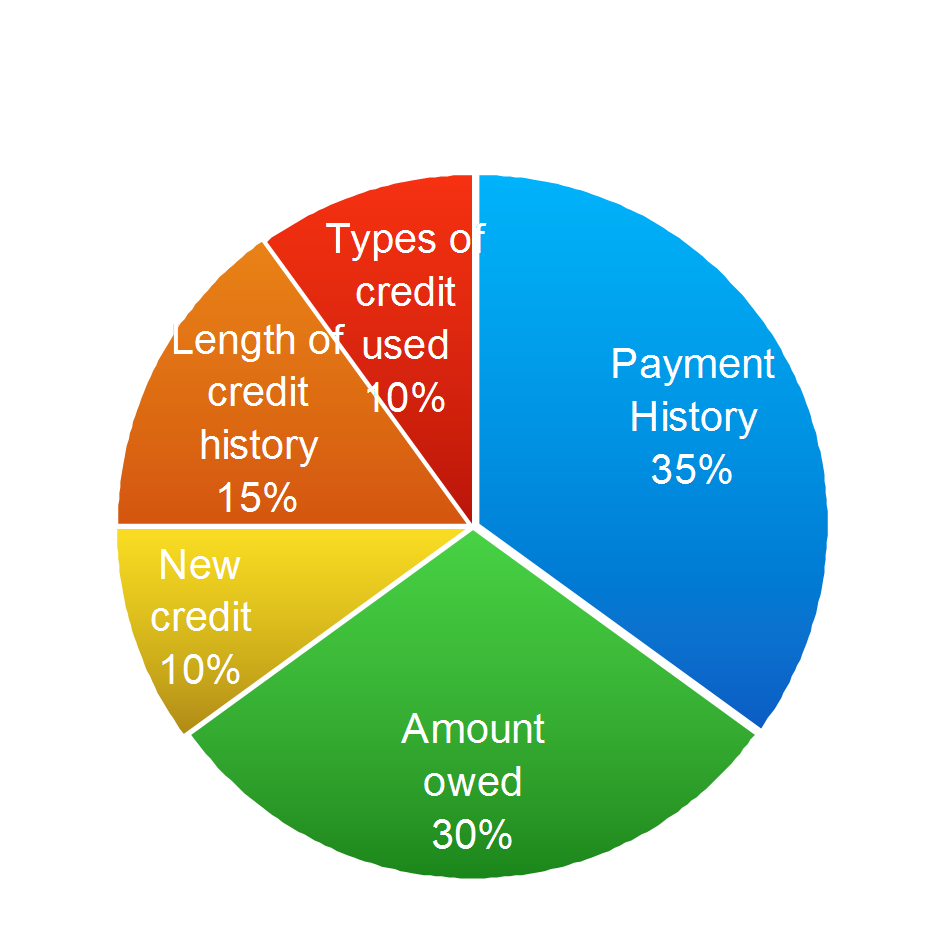

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break your credit! […]

The simple answer according to FICO is 715. But average means different things when it comes to one’s age, where they live, and how much money they make. There are also so many scoring models out there, it’s hard to tell where one stands. One thing for certain is getting yourself in a position to […]

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

From a young age we were taught the importance of living debt free. When assessing your personal finance goals, you may find it tempting to close out some of your credit card accounts in an attempt to lower your debt. To many, it may feel good to close out an account that held negative payment […]

From a young age we were taught the importance of living debt free. When assessing your personal finance goals, you may find it tempting to close out some of your credit card accounts in an attempt to lower your debt. To many, it may feel good to close out an account that held negative payment […]

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break […]

Believe it or not we live in an age where much of what goes on in our daily lives is monitored, collected and sold to interested parties. Our driving records, our medical history, our internet traffic and most importantly our credit information. Which can make you vulnerable to identity theft or a mistake […]

- 1

- 2