So You’re Saying There’s A Chance? All jokes aside, credit repair is a very serious matter. We have come into contact with many companies that over promise and under deliver when it comes to the services they offer. Have you been teetering back and forth between companies but have been unsure what to ask? Well […]

Monthly Archives: July 2018

Is Rent-To-Own A Sure Thing? The here and now seems to take the front seat as opposed to decisions that are best for the budget for a lot of families. “We need more space.” “Our credit isn’t where it needs to be.” “What is the quickest way to start building for our future and not […]

Back To School For College Students Is your college student packed up and ready to start a new chapter already? At some point as a parent, you have probably discussed the do’s and dont’s during the first year when your student is ready to take off and start a new chapter on their own. You […]

Patience Pays Off While going through the home buying process, the word patience for most may be a sore subject. Between the pre-approval process, the home search and offer, it can become a stressful time. Not to mention if you get caught in a bidding war or the home you want has issues after inspection. […]

Building Up Your Fico Understanding and building credit in a positive way takes discipline and some education. Do you recall being taught in school, how to build your credit scores? Did your teachers let you know how big of a role credit would play in your life as you got older? Honestly, it is probably […]

Credit Card Debt & Balance Transfers Where is your credit card debt currently at? Are you making minimum payments that don’t make a dent once your interest rates kicked in? It may be time to weigh a different option now that you are hoping to make some headway on your current debts. Your Balances and […]

Credit Scores Dropping Have you noticed a random decrease in your credit scores recently? There are many factors that can cause your credit scores to fluctuate. Many consumers do not understand that a credit score has no memory and can change immediately due to activity or changes that can happen as soon as you make […]

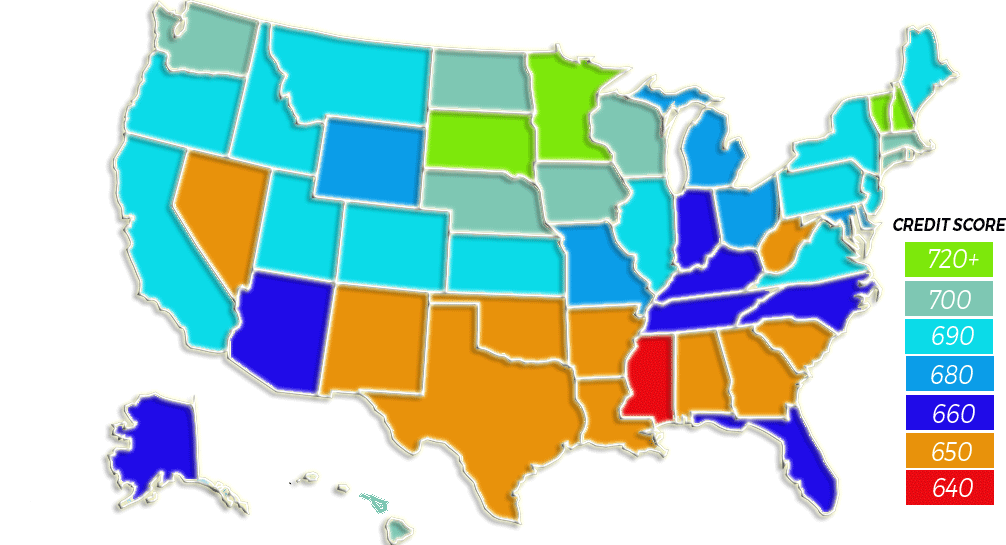

Battle of the States Have you ever wondered what part of the United States has the best/worst credit scores? It may come as a surprise to you but, the highest scoring state, Minnesota has an average credit score of 709. What may come as even more of a shock is that yes, they do have […]