Memorial Day is the day we honor those men and women who took the ultimate sacrifice and in return giving us the greatest gift as United States Citizens, FREEDOM!What a great honor to live in this Country and to be given this wonderful gift, here at Credit Law Center we want to express our heartfelt […]

Monthly Archives: May 2017

Wow! With the cost of rent rising have you ever thought about buying a home? It is important to weigh the pros and cons of renting vs buying. Credit scores are a factor in buying a home, but there are many different programs for future home buyers can help them get approved for a loan. According to a recent report by Zumper National […]

A divorce decree is the final courts ruling or judgment in the termination of marriage. In this final judgment, the two parties will divide properties, determine spousal/child support and divide financial debt. Something that is brought up a lot in regards to credit reports and debt collections is, my spouse was supposed to pay that […]

If you want to purchase a home the best possible way to guarantee you are on the right track is to see a mortgage lender. A lender will be able to help you in the pre-approval process. The pre-approval is a promise from the bank that you are qualified to borrow up to a certain amount at […]

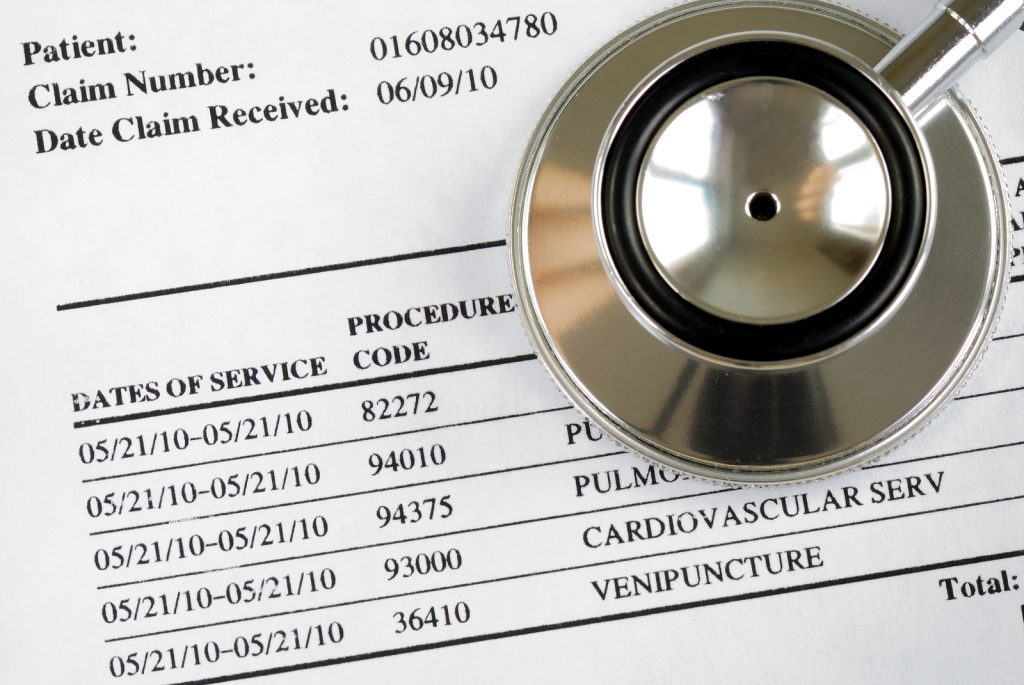

With social media so present in our lives now we see the amount of GoFundMe pages for medical bills, it is validating the statistics. According to a recent report, by the CFPB 43 million Americans have overdue medical debt on their credit reports. Approximately 2 million Americans are affected annually by medical debt and remains the leading […]

From the day we bring home our children from the hospital all we want to be the best at guiding them and teaching them. It’s a no brainer we will be the one teaching them to tie their shoes, brush their teeth, and most of us will be that one parent waiting up for them […]