How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Category Archives: Credit Repair Blogs

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

Whether you are applying for a new credit card or a home loan, hard inquiries are constantly present when attempting to build credit. Although hard inquires are one of the most common items found on a credit report, there is still much mystery surrounding their effect on a credit score. In todays “Fact or Fiction” […]

How long does it take actually to take for the credit repair process? There seems to be no definite answer on the time frame for how long the credit repair process takes. If you google it, you will see there is not a standard amount of time and no straightforward answer. Unfortunately what happens most […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

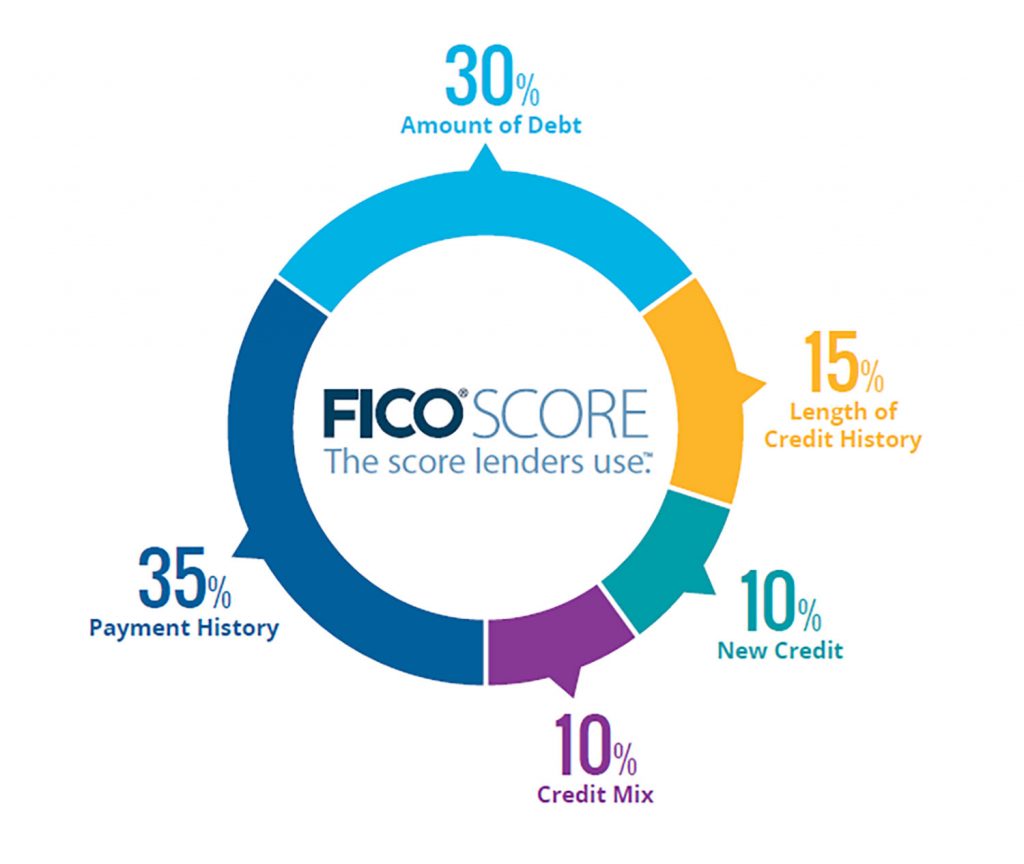

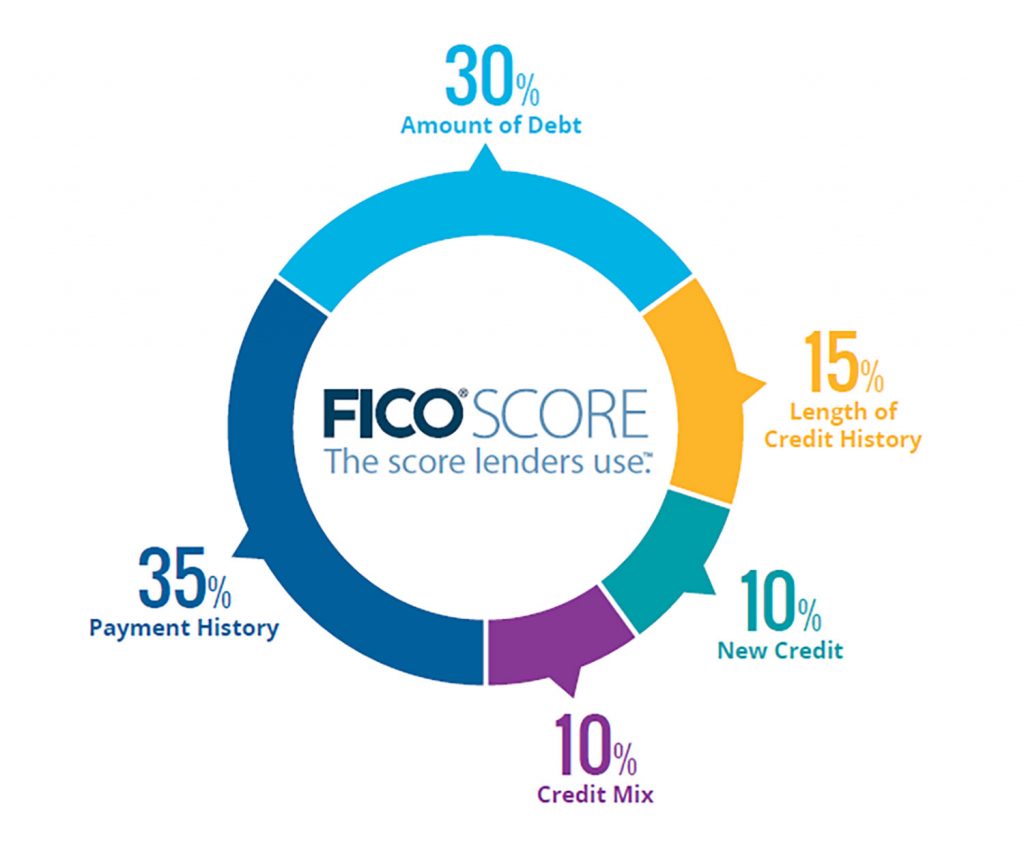

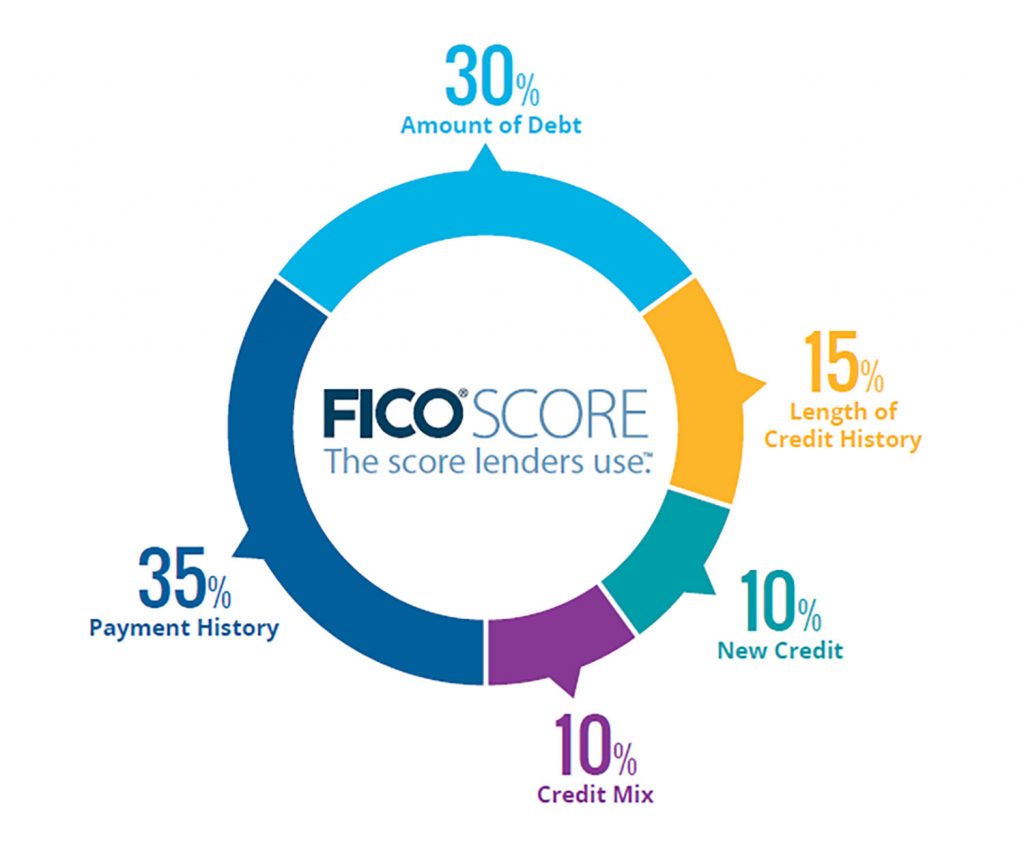

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break your credit! […]

So You’re Saying There’s A Chance? All jokes aside, credit repair is a very serious matter. We have come into contact with many companies that over promise and under deliver when it comes to the services they offer. Have you been teetering back and forth between companies but have been unsure what to ask? Well […]