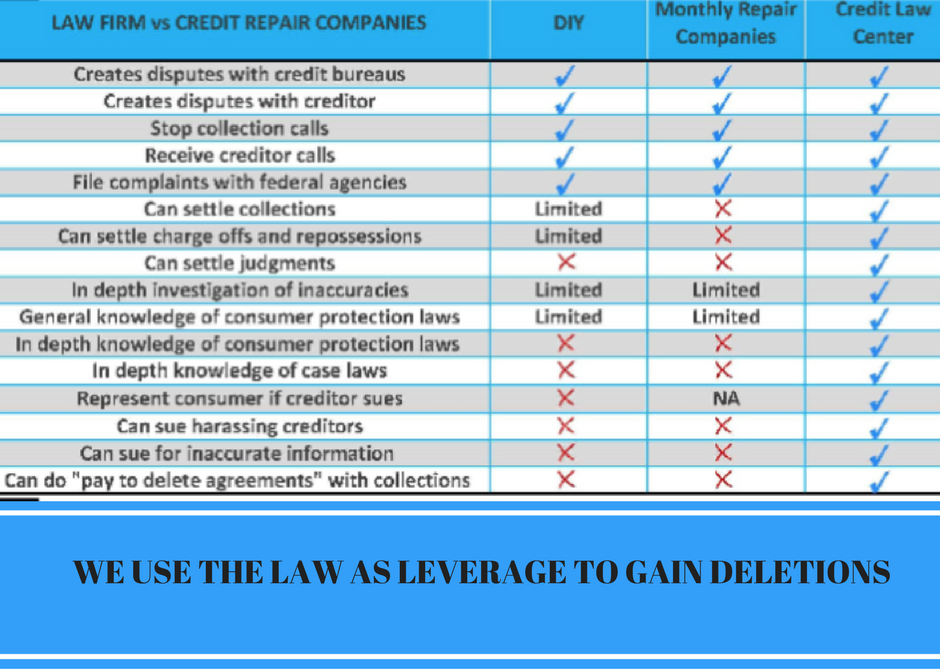

A law firm, like Credit Law Center has the ability to do more than both a consumer and what a credit repair company can. The side by side shows just a few things that you may want to start quizzing your current or potential credit repair company you hire on and start to look for companies that can help you out in all aspects of credit repair.

1. What Will I Need To Get Started?

In order to enroll in credit repair with Credit Law Center you will want to speak with a credit advisor first. They will walk you through our process and what you can expect as far as cost and time frame goes. You will know after your consultation what the cost could be for credit repair if every item came off the report.

You will notice we said if everything comes off. Each item is priced per line item as we only want to charge a client for the successful removal of what we dispute. You would receive a contract ceiling price and be billed accordingly after each round is completed. We are a pay for performance company, which just means you will only pay us for results as opposed to a monthly repair company.

Next, you will need a copy of your credit report, which the credit advisor will pull with you. They will go through line by line with you and educate you on how you can improve scores while we work on any derogatory items on the report. You can expect to pay $1 at the consultation and then decide if you would like to work with our Law Firm. Again, you will be quoted all pricing before ever signing a contract.

Although the cost may sound cheaper per month for a monthly program, and manageable for your budget, it might hurt you more in the long run. Too often we see consumers that agree to this and they end up signing up for something that takes years for them to improve their credit. Our typical time frame is 60-120 days depending on what other items are positively reporting on a report.

We will work inside anyone’s budget!

Finally, a contract will be emailed to you and after a few ID’s submitted to your credit advisor, you will be ready for credit repair! We are built for speed and this is why 53% of our business comes from referral partners like loan officers and real estate agents. They can expect that their clients will get results quickly, and be ready for financing.

2. Is There An Attorney Involved/Working For Me?

We currently have 3 attorneys in the office that our clients can speak with about their credit reports or any legalities they may come across during or after credit repair. These attorneys also have the ability to work on your behalf, to stop collection calls as well as work with you on what you can say now that you are a client. When a collection company calls you and you are represented by a law firm, you have the ability to request no further communication at that time. Should you continue to receive calls, you may be able to sue for continued harassment.

Does your current “law firm” have the ability to do this? Ask the hard questions!