Buying your first home is a daunting milestone in everyones life and can bring both joy and anxiety when beginning the process. One large source of anxiety comes from the ever looming need of an acceptional credit score to aquire acceptable rates. For those that meet this criteria as displayed by your credit monitoring service; […]

Tag Archives: credit law center

How Does A Decrease In Credit Limit Effect Me? Your credit utilization rate is one of the most important factors when it comes to your credit score. Depending on how much of the available balance you use will reflect what kind of borrower you are and can be the deciding factor in a substantial credit […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

Inboxes full of spam and junk mail, texts coming from unknown numbers alerting you to new investing opportunities, “urgent” mail with pre approved credit and loan offers, and new marketing practices are just some of the annoyances the average consumer must face on the daily. In todays blog, we will go over how to opt […]

There is a major difference between what a credit repair company can do versus what a law firm specializing in credit repair can. What you may find even more interesting is that a consumer can actually do more than what a credit repair company will. A Law Firm however, trumps all. We have been using the law […]

Acclimating to New Changes Last year was an interesting year; with the COVID-19 pandemic and the presidential election, everything seemed slightly different. However, not everything that happened last year was negative, with the previous year bringing some significant updates to VA home loans, which have since significantly increased their usage. According to recent data, the […]

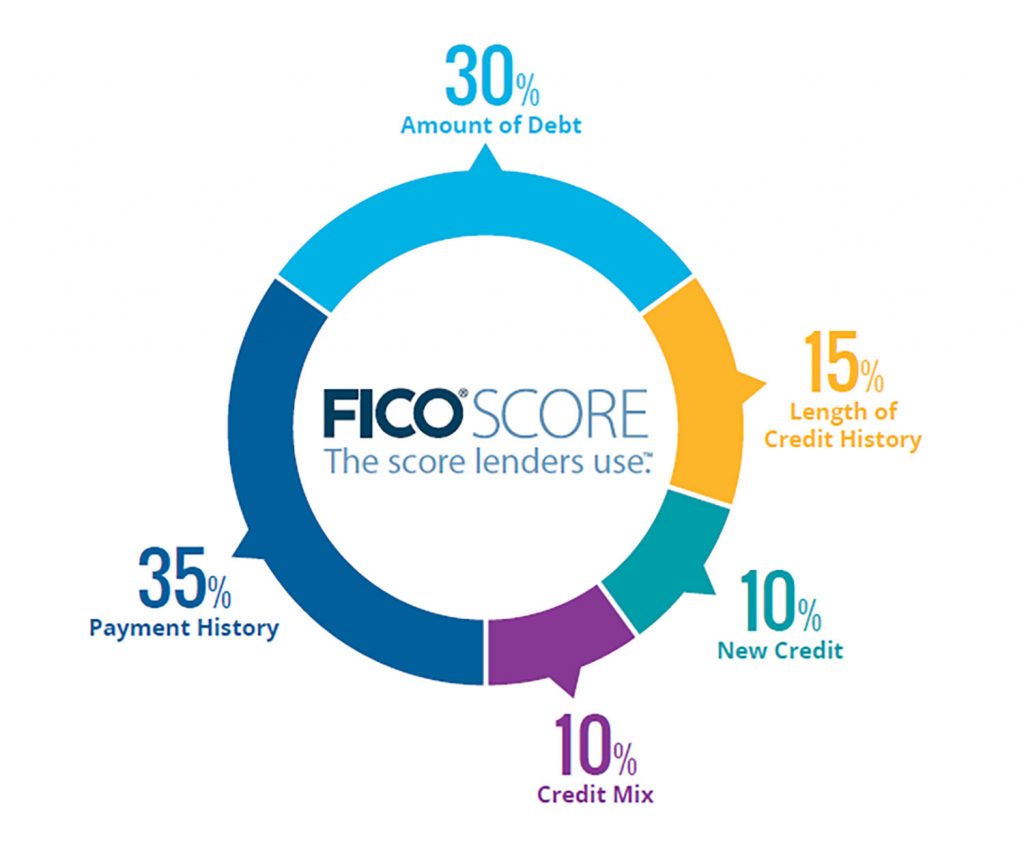

Time to Pass Go: How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is going to […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break your credit! […]

So You’re Saying There’s A Chance? All jokes aside, credit repair is a very serious matter. We have come into contact with many companies that over promise and under deliver when it comes to the services they offer. Have you been teetering back and forth between companies but have been unsure what to ask? Well […]