How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Tag Archives: Transunion

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

As of July 1st, 2022 all medical debts that have been paid, whether the debt was held by a physician or a collection agency, must be suppressed from a consumer’s credit report! This was announced by all three CEO’s of Equifax, Experian and TransUnion in April of 2022. Now before we start patting these CEO’s […]

Your past financial decisions may feel like they are coming back to haunt you, and handling the complications that arise from having a less than perfect credit score can be rather stressful. Dealing with your past credit mistakes can leave you feeling extremely frustrated and hopeless, but the good there is re-establishing a good credit […]

Are you being sued by a debt buyer? If you have, you’re not alone. Our office has seen a significant increase in clients coming in with lawsuits from debt buyers. What is a Debt Buyer A debt buyer is a company that purchases delinquent debt from original banks and credit card companies, these companies then […]

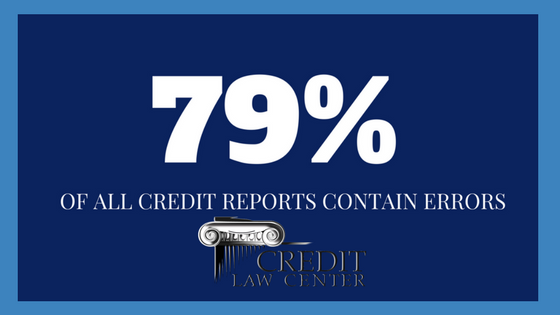

Hard to believe that 79% of all credit reports contain errors, but according to the FTC it is true. I know you are thinking!!!! How many of us would still be employed if we even made half the mistakes as the credit reporting agencies do on a consumers report? So… When was the last time […]

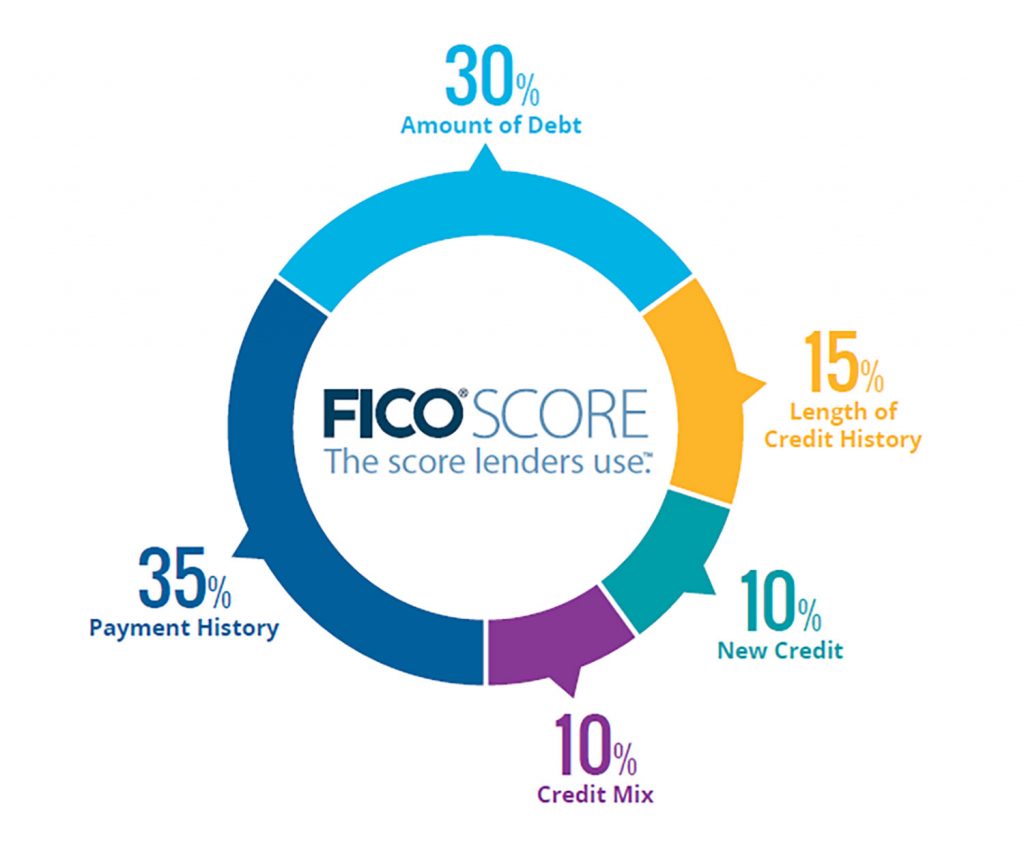

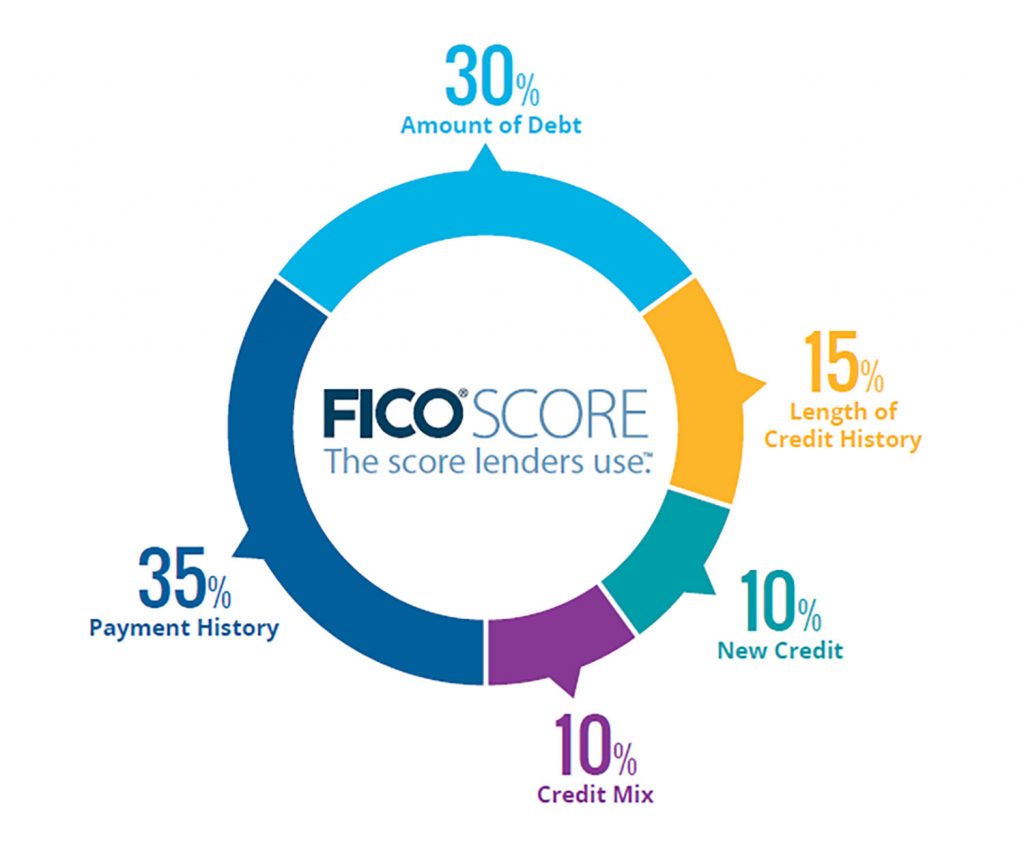

A credit report is a detailed compilation of information about the way you handle your debt, which is managed by businesses known as credit reporting agencies. In the United States, we have three major credit reporting agencies Equifax, Experian, and Transunion. All three credit reporting agencies collect your detailed information from lenders to create a […]

Are free credit scores a waste of your time? Last week, 2 of the big 3 credit bureaus were ordered to pay $23 million for deceiving customers. The CFPB accused the credit bureaus of misleading marketing of false information of credit scores and products being sold to the public. According to the regulator, “TransUnion and Equifax […]

2 of the big 3 credit bureaus busted for deceptive marketing – Credit Law Center The Consumer Financial Protection Bureau bust 2 out of the 3 major credit reporting bureaus due to the marketing of their over-priced, under-performing credit monitoring subscription products. Combined fines and consumer restitution total $23 million. CFPB will more than likely […]