How Do Negative Items Affect Me? Negative items on your credit report could be what separates you from that home loan you hoped for or a decent financing for a vehicle. The good news is that if you happen to have these negative items on your credit report, there are still wats to mitigate their […]

Tag Archives: Kansas City Credit Repair

The Ultimate Cheat Sheet on Student Loans The price for higher education is rising, as is the numbers on student loan debt. What is deemed necessary to be successful in today’s world, is also what is holding many folks back from financial freedom. While many are trying to get ahead in their lives, student debt […]

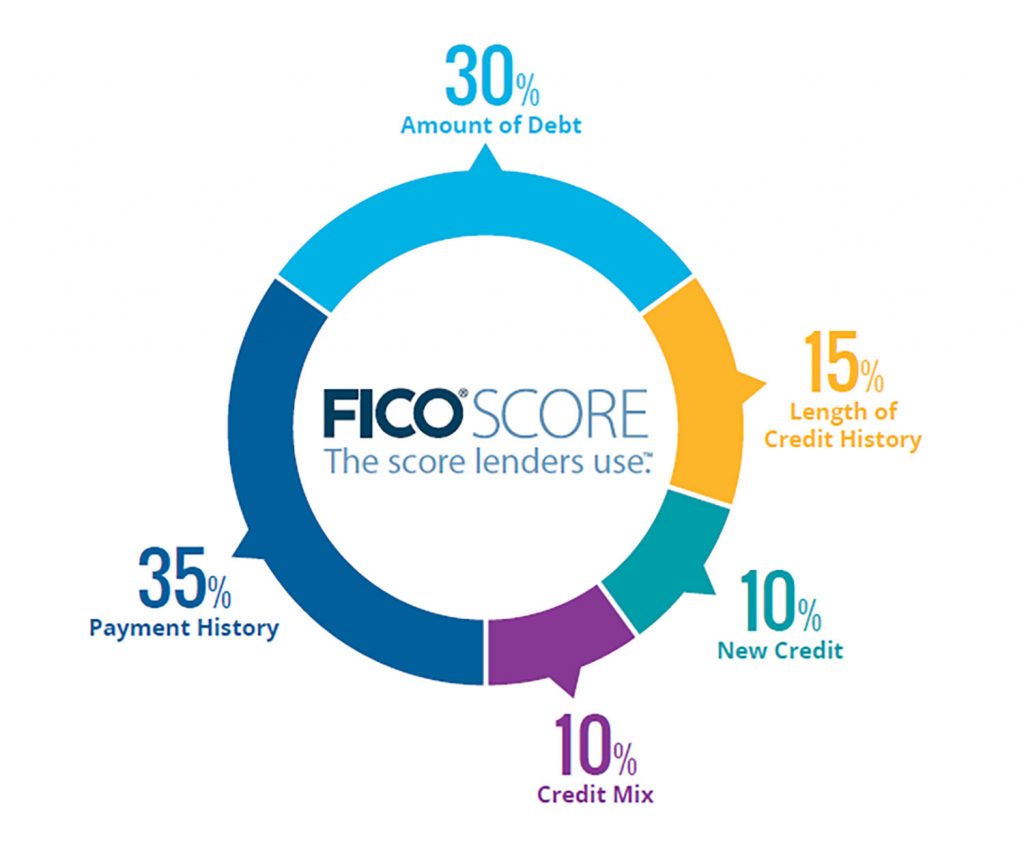

What makes up your FICO score and how is it calculated? A FICO score is a 3 digit code measured by pulling data from all three credit reports, Experian, Transunion, and Equifax, it is then used to determine your credit risk to lenders. The information pulled is put in to a FICO Score Formula, as […]

Are Debt Collectors or Debt Buyers Calling you? – Credit Law Center Do you immediately send an unknown call to voice mail, knowing it is just another abusive debt collector? Debt collectors and debt buyers spend lots of time and money going to seminars and workshops to stay up to date on all the rules and regulations. […]

Are free credit scores a waste of your time? Last week, 2 of the big 3 credit bureaus were ordered to pay $23 million for deceiving customers. The CFPB accused the credit bureaus of misleading marketing of false information of credit scores and products being sold to the public. According to the regulator, “TransUnion and Equifax […]

2 of the big 3 credit bureaus busted for deceptive marketing – Credit Law Center The Consumer Financial Protection Bureau bust 2 out of the 3 major credit reporting bureaus due to the marketing of their over-priced, under-performing credit monitoring subscription products. Combined fines and consumer restitution total $23 million. CFPB will more than likely […]

Merry Christmas and Happy New Year from Credit Law Center Tis the season of giving and celebrating life. Credit Law Center would like to take a moment and thank all previous and current clients, referral partners, and employees for making Credit Law Center what it is today and giving us an opportunity to help you. […]

Self Credit Repair – Credit Law Center What is self credit repair? Sounds like a silly question but this industry can be confusing to consumers. The credit reporting agencies only want self credit repair because When considering self credit asks yourself a couple of questions; do you change your own oil? Do you do your […]

- 1

- 2