A Step in the Right Direction

Potential new changes in the credit world can seem to be irrelevant and often times have little to no impact (or so it seems) for the consumers. There are many changes on the horizon that will take effect just one year after President Trump signs a new bill.

Congress has passed the Economic Growth, Regulatory Relief, and Consumer Protection Act. This bill has an impact in the credit world because it will be also amending parts of the Fair Credit Reporting Act (FCRA). The Dodd-Frank rollback bill is the most recent part of legislation to go in and amend the FCRA.

The FCRA regulates how the credit bureaus and customers operate and the this bill being passed will start to hone in on several things-

- Debt Protection (Veteran and Active Duty)

- Changes in Scoring Models

- Student Loan Debt

- Fraudulent Activity

Debt Protection (Veteran and Active Duty)

Our military personnel sacrifice time away from home, their families and sometimes their lives. An exciting change in this bill means:

- Medical debt acquired by a veteran may not be reported at the bureau level for at least one year from the date the medical services took place

- Medical debt acquired by a veteran that has been sent to collection status has to be removed from the credit reports once the debt is paid off or has been settled (the current rule says after 7 years or immediately after the collection has been paid by insurance)

- Medical debts must be removed from the credit reports if the medical debt is or has been assumed by the Department of Veteran Affairs (there is no existing rule on this)

- A database must be created by the Secretary of Veteran Affairs to verify whether or not the debts reported are actual veteran’s medical debts

- Free credit monitoring services from the reporting agencies will be given to active duty military personnel

All of these changes will take effect 1 year from the date the bill is signed.

Changes in Scoring Models

- Fannie Mae and Freddie Mac will be able to use “newer” generation credit scores for underwriting home loans if the newer score is “reliable and accurate” (how they are going to measure reliable and accurate has not been defined quite yet)

- Currently Fannie Mae and Freddie Mac are using older generation FICO scores (FICO 4) but have not been able to upgrade to newer scoring models (like FICO 9). This is important for borrowers because using the newer versions could help them receive better rates and terms for a mortgage

These changes are not set in stone, but could be a potential positive spin for consumers.

Student Loan Debt

If a debtor can now show willingness and consistent, timely payments (on a private student loan) they can request that the lender go straight to the credit bureau and remove record of the defaults on the student loan. This can only be done if the lender offers a loan rehab program.

Fraud

Child credit protections: Parents and guardians can freeze a minor’s credit report (children ages 16 and younger). If a minor child has no credit file, the bureau is required to make a credit file and freeze it. All of these services will be free of charge.

Credit Freeze: Before, the bureaus only allowed for credit freezing to be given to consumers, free of charge, if they had been a victim of fraud. Initially, there were fees for setting a freeze and fees to remove that freeze as well. When the credit freeze is set, the bureau then has to confirm it and provide instructions on how to remove it. All of these freezing capabilities (freezing, thawing, re-freezing) will be free to consumers at the national level.

Alerts:After the change, alerts can now last for one year. Victims of fraud can also place their credit reports on alert or be placed on an extended alert that will last 7 years. A fraud alert will notify users pulling credit reports (lenders and banks) that they must take steps to further verify that the person applying for credit it undoubtedly, the person applying.

These changes will begin 120 days after President Trump signs the bill.

Credit Law Center partners with Home for Heroes and provides significant discounts on services to all military personnel. If you would like one of our attorneys or credit advisors to take a look at your report, please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.

A Note From The Author: The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.

Article by Breana Washington

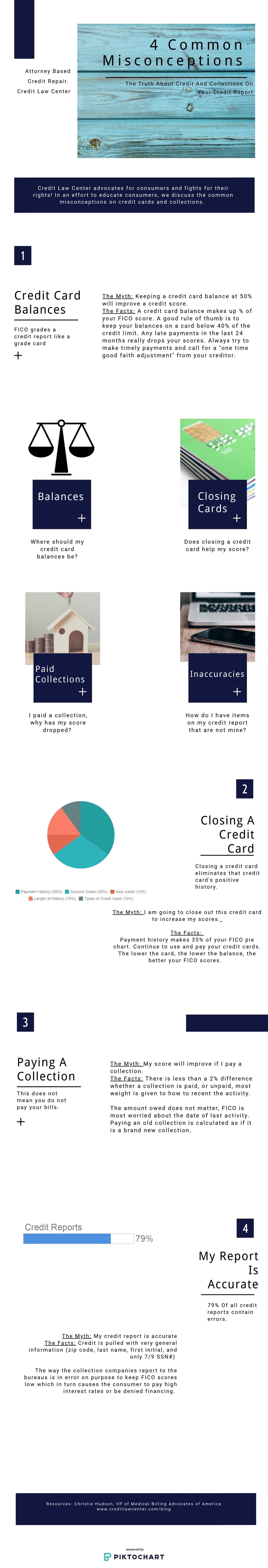

Check out Credit Law Center’s info-graphic on 4 myths of collections reporting on credit reports.