Does unemployment affect my credit?

Unfortunately job loss is something many American’s experience in their lifetime. The loss of a job means financial hardships, which directly affects our consumer’s credit. Here is what you need to know about how job loss can affect your credit scores.

Loss of Savings:

Money that was saved for emergency may have to be used. It is hard to replenish those funds but for times like these, this is why that savings is vital!If you did not have a great credit score prior to losing the job, you may look into a secured card. A secured card requires the consumer to open an account with the issuing bank. If you do not have the money to put down the deposit for the card, this will not be a route you can take. Your savings may start to dwindle but hopefully those depleting funds will be able to be replenished after you secure new employment.

Late Pays:

If you experience long term unemployment, unfortunately your credit will be greatly impacted! If you fall behind 90 days late, this is a serious delinquency and will dramatically drop your scores. You may want to read the blog here on late payments. At this point, the last thing folks are worried about is their credit score, especially if they have a family to care for. Does this sound like something you have gone through? Let us take a look at your report to see what we can do.

High Balances:

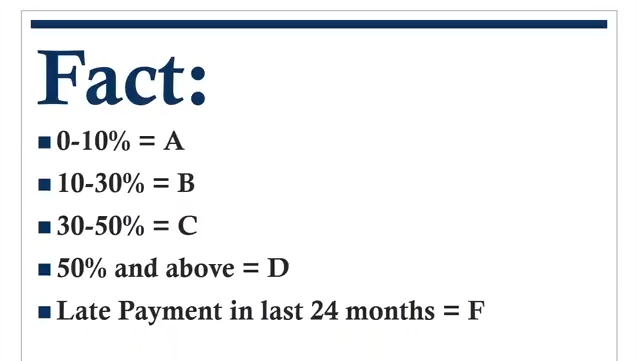

Making minimum payments on credit cards will start to hurt your scores. You will start to see your credit score decline when the balances and interests start climbing. Once that balance reaches above 30% of the limit, your scores start to reflect it in a negative way.

Ways unemployment does not hinder a credit score

If you are unemployed, rest assured that anyone that is looking at your credit report will not know. There are not any boxes on a report marked that a lender, employer, or insurance company would be able to see. Unemployment claims are not public record and benefits are not debts. You are not obligated to repay those unemployment benefits at all, so thankfully this will not be a dark cloud lingering with the rest of your bills after you are back on your feet.

Change in Income:

Though credit reports used to contain your salary, that is now a thing of the past. The difference in income will not show up, however if you are applying for loans you should expect to have to provide documentation and proof of income.

At Credit Law Center we understand that while financial hardships may fall on a consumer, often there is more to the story than not paying bills. The credit bureau’s do not care what our consumer’s go through. We want to help you get your buying power back and get you back on your feet! If you are in need of a FREE consultation please visit our website and talk to an advisor!

A note From The Author:The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.