Impact of Timeshares on Credit Reports

A timeshare can be something that affects your credit scores. When thinking about purchasing a timeshare, consider it to be as vital and possibly as damaging as a mortgage to your credit report.

There are many variables that come into purchasing a timeshare. If your family is tossing around the idea, examine these factors prior to signing:

- Know the Association Fees

- What the payments look like

- What happens if you need/want to sell

- Review contracts and terms

Credit Scores Dropping

In the credit world, the collection companies and bureaus do not consider what has happened and why you cannot make a payment on a debt. Should something happen where you no longer wish to be connected to the timeshare, they still want to be able to collect your money. It is possible that when you attempt to sell a timeshare, your credit report will state “deed-in-lieu” which can have as negative an impact as a foreclosure on the report. I caution you to really consider the purchase you are making and consider what your other lines of credit look like and if a timeshare is in your best interest. Here are a few other ways the timeshare could potentially drop your credit scores:

Timeshare Fees

As with any mortgage, your time share could have HOA fees, special assessments, utilities and taxes to be paid. If you can no longer afford to pay these obligations in the timeshare, a lien can be put on your portion of the home. Not only does this impact your credit, it can keep you from selling out of your portion of the timeshare or making future major purchases.

Payments

If your family decides to mortgage the timeshare, you will have to continue the payments until the entire debt is repaid. Falling behind on the payments? They can foreclose the timeshare as if you stopped paying on a normal mortgage payment for a home. This dramatically impacts your credit scores, and could stay on your credit report for seven years.

Selling

It can be extremely difficult to find someone to sell a timeshare to. Whether you decide to discount the cost to the potential buyer, you still have the potential to end up in a bad financial position. The “deed-in-lieu” can be put on your credit report, regardless if you sell the timeshare outright or not.

Potential for Cancellation

In most states, there is a rescission or “cooling off’ where the buyer has the opportunity to cancel a contract and be given the deposit back. When that time frame is over, most believe that they no longer have the ability to leave the contract.

The best way to legally end the timeshare contract is take it straight to the company you purchased it from. The company you signed the contract with will not be thrilled about taking the timeshare back, and may try to convince you otherwise however, if they feel that there is potential litigation, they will more than likely take back the agreement or release the owner from the contract.

It is not impossible to be relieved of the contract you have on a timeshare but it would be wise to look into other avenues other than this option.

The last thing you need when trying to enjoy a vacation spot, or a summer with your family is the stress of an unwanted timeshare with unrealistic fees and expectations. I urge you to think twice before you purchase a timeshare this summer.

Other fun and convenient ideas for a great vacation that allows for your family to come and go is purchase an Air BnB while continuing to make money by renting it out when you are absent.

If you have a tax lien, foreclosure or are thinking about trying to get out of a bad financial situation due to a timeshare and would like one of our attorneys or credit advisors to take a look at your report, please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.

A Note From The Author: The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.

Article by Breana Washington

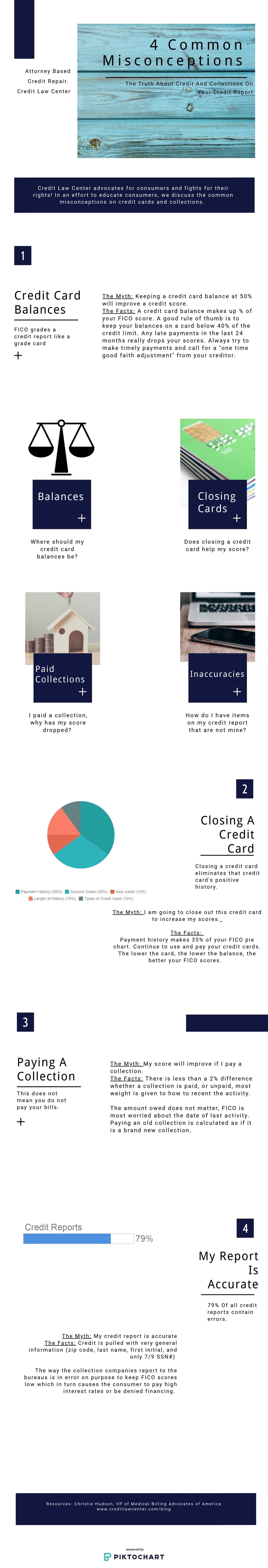

Check out Credit Law Center’s info-graphic on 4 myths of collections reporting on credit reports.