A Record-Breaking Year

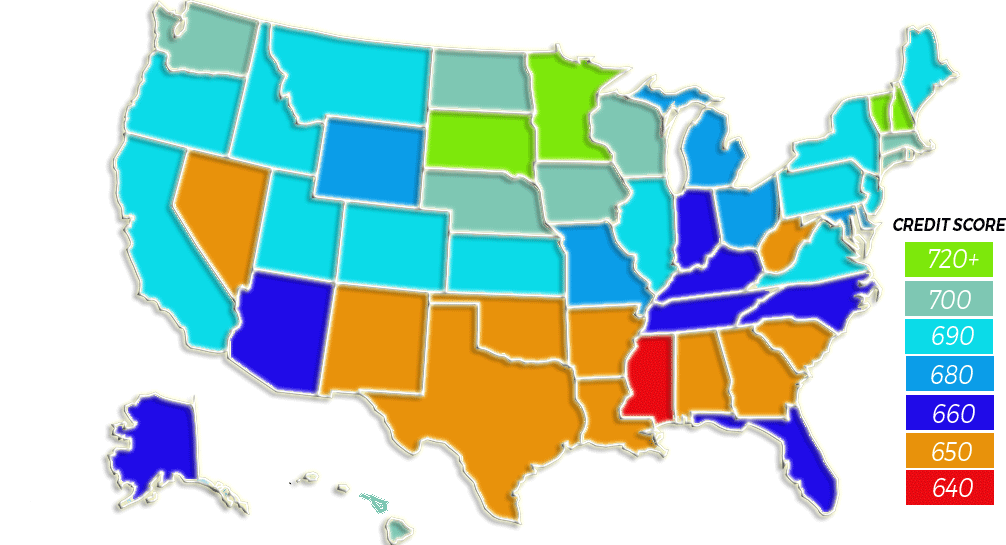

We have seen the highest average credit score ever in 2019 and the numbers keep rising! The U.S. economy is truly booming: Record job growth caused unemployment rates to drop to a record low and the stock market flourished throughout the year. Consumers showed their confidence as they continued to borrow and spend energetically and responsibly! Below is a list of each state and their average credit scores throughout the year of 2019!

Alabama- 680

Alaska- 707

Arizona- 696

Arkansas- 683

California- 708

Colorado- 718

Connecticut – 717

Delaware-701

Florida- 694

Georgia- 682

Hawaii- 723

Idaho- 711

Illinois- 709

Indiana- 699

Iowa- 720

Kansas- 711

Kentucky- 692

Louisiana- 677

Maine- 715

Maryland-704

Massachusetts- 723

Michigan- 706

Minnesota- 733

Mississippi- 667

Missouri- 701

Montana- 720

Nebraska- 723

Nevada- 686

New Hampshire- 724

New Jersey- 714

New Mexico- 686

New York- 712

North Carolina- 694

North Dakota- 727

Ohio-705

Oklahoma- 682

Oregon- 718

Pennsylvania- 713

Rhode Island- 713

South Carolina- 681

South Dakota- 727

Tennessee- 690

Texas- 680

Utah- 716

Vermont- 726

Washington- 723

West Virginia- 687

Wisconsin- 725

Wyoming- 712

FICO Score Range

Very Poor: 300-579

Fair: 580-669

Good: 670- 739

Very Good: 740-799

Exceptional: 800-850

With FICO Scores seeing a 14-point increase and loan delinquencies significantly reduced since 2010, Americans seem to be maintaining healthier overall credit habits while also feeling bullish about growing balances across credit cards, retail cards, auto loans and even mortgages!

Do you have questions about your credit report? If you would like to speak with one of our attorneys or credit advisors and complete a free consultation please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.

Check out Credit Law Center Reviews:

Google Reviews, Facebook Reviews

This entry was posted in Credit Repair Blogs and tagged credit law, Credit Repair Companies, kansas city, Kansas City Credit Repair, National Credit Repair. Bookmark the permalink. Follow any comments here with the RSS feed for this post. Both comments and trackbacks are currently closed.

« Credit Repair Kansas City – Credit Law Center • Fast Credit Repair Kansas City »