Credit Law Center explains three things to do to improve a credit score in the next 24 hours. First, add a new account or become an authorized user. Second, is to pay down your credit cards or balances. Third, pay for deletion. We have broken these tips down for consumers to understand what will work best or what fits with their current situation.

Add new account/authorized user: Adding a new account will not cost you any money. Becoming an authorized user to an account that is in great standing (spouse, parent, sibling) will immediately impact your own credit report. If you do not have a good mix of credit, this may be a great option. We tell clients two revolving and two installments is a good, healthy mix of credit. If you are working with a lender and trying to become approved for a home loan, check with your Loan Officer on the authorized user as sometimes, if that is your only revolving account, underwriting will not approve you.

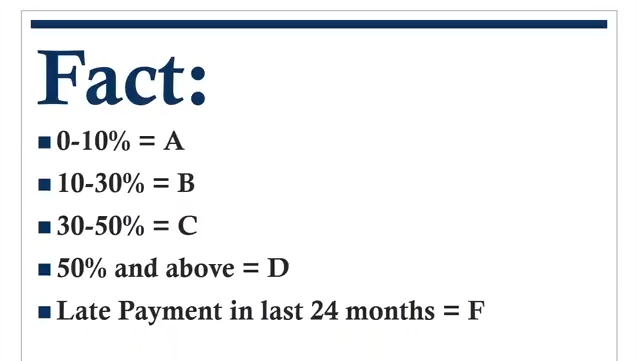

Pay down and lower utilization: This step, if you have some money to put towards lowering those balances, your utilization ratio will really help. Often times, people are told to pay their accounts down to zero. Another idea, if extra cash is not on hand, is to ask for a credit limit increase. This is not an excuse to go shopping, however, helps again with that utilization ratio. Good rule of thumb is to look at the report as a grade card. A credit Score is ascending not descending. So, you do not start with an A and lose points, you start at the very bottom or a 350 score and gain points based on the types of accounts you have.

Pay for deletion: Credit Law Center uses pay for deletion as one of the tactics for our clients. This is a great article on the DIY way to attempt pay to delete on your own.

In conclusion: A lot of people assume your credit score is based on history so it will remember everything, right? Your credit score has no memory. As that report changes it doesn’t remember past information, it only knows what info is had right then and there. Your scores are only calculated when a current report is ordered. It is all based off of the information that is on the file at the time. If you can change that information or update it each time that score continues to change each time. If you have inaccurate information on a Monday and it is removed Monday evening, by Tuesday it is gone. Those changes have immediate impact on the score. Therefore, if you make changes to your balances and pay cards down and order a new report, the scores will reflect it.

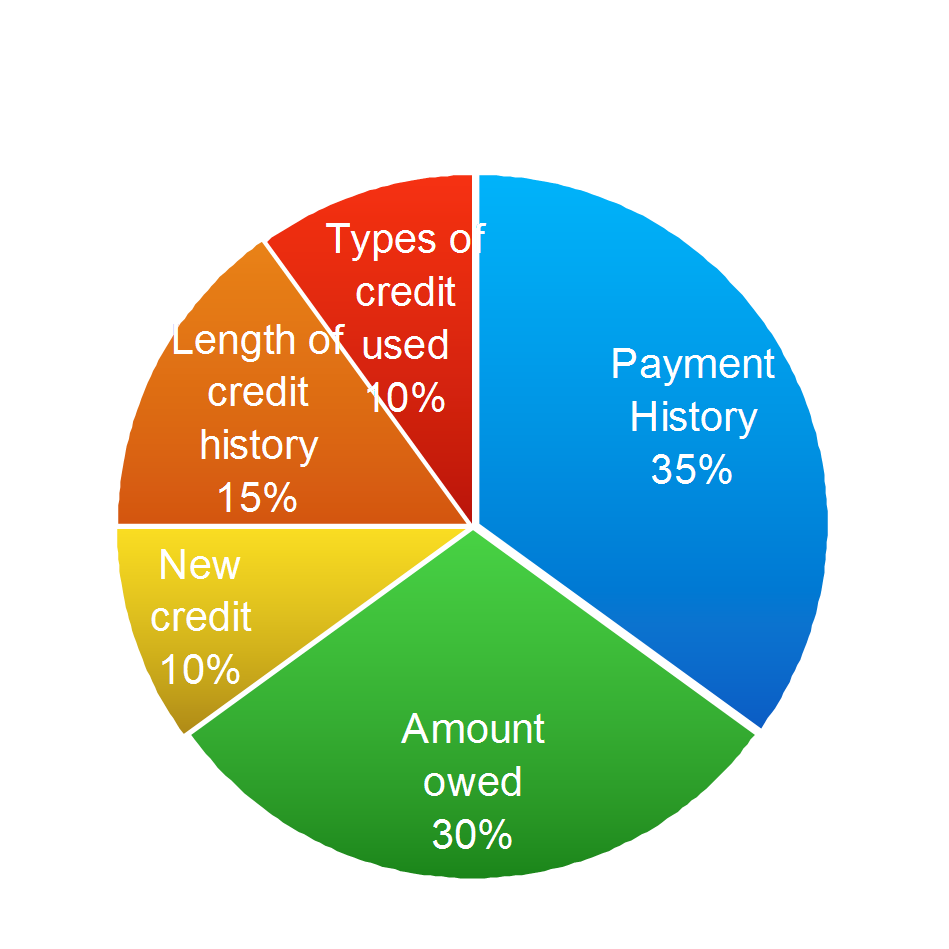

35% of the credit score is based on payment history. Amount owed on your cards makes up 30%. The other 35% is made up of types of credit used, length of history, and new credit. When a consumer has a late payment, it takes a long time to recover. Looking at your report and understanding the credit world is important in order to maximize your scores. If you would like additional information on how to improve your scores, please contact us!

A Note From The Author:The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.

Article by Breana Washington