I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

Category Archives: Credit Repair Blogs

This is really not breaking news at this point. It’s been happening for a couple of years now. But I do think it worth mentioning again. Debt Collection companies CAN try and collect via your social media accounts. Over time, our communication process has changed dramatically. The idea of making a phone call when […]

So you want to buy a house. But your credit score is 675 instead of 720; which will get you the better rate on a home loan. If you want to raise your credit score quickly, there are some steps you can take that can guarantee an exceptional home loan or any other credit line […]

How long does it take actually to take for the credit repair process? There seems to be no definite answer on the time frame for how long the credit repair process takes. If you google it, you will see there is not a standard amount of time and no straightforward answer. Unfortunately what happens most […]

Here at Credit Law Center we run into many clients that may have not established credit or they are in a position to where they are need to recover from bad credit. They need to establish open lines of credit to help improve their scores. Talk about being stuck between a rock and a hard […]

When looking at a credit report, many folks will see collections and charge offs. What’s the difference? Simply put, a Charge Off is a term a lender will use when the consumer has not made the contractually agreed payments. The lender has tried repeatedly to contact the consumer for re-payment with no response. So, the […]

What is a credit score? Most people would answer that this is how lenders see if you are able to receive a loan and at what interest rate. And that’s true. But really, it’s an algorithmic number telling a lender how likely a person is to default on a loan within the first 24 months. […]

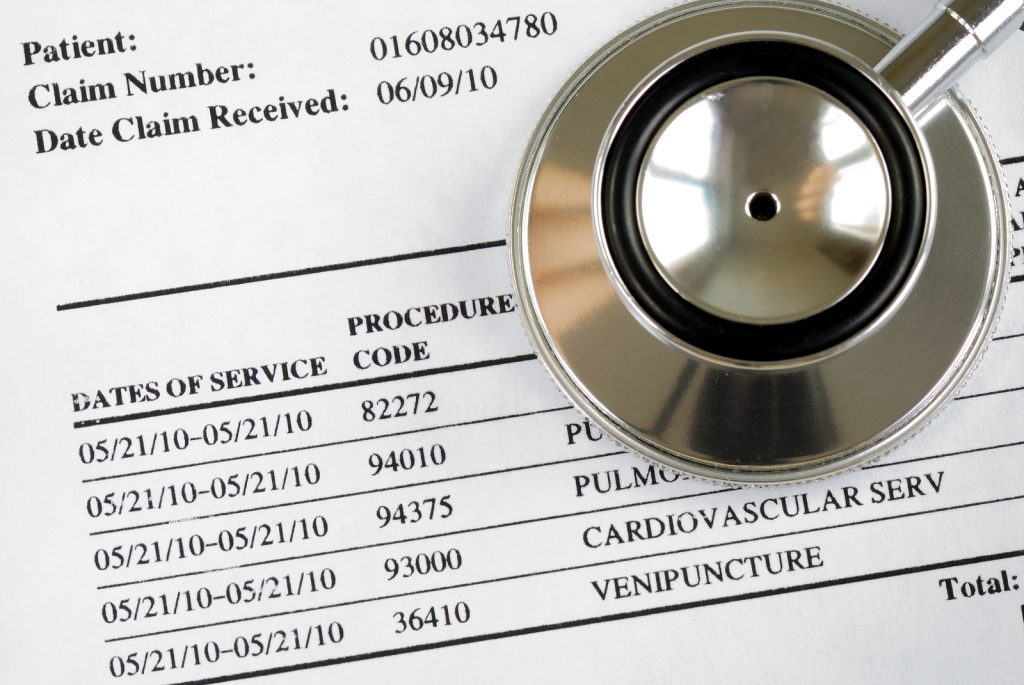

As of July 1st, 2022 all medical debts that have been paid, whether the debt was held by a physician or a collection agency, must be suppressed from a consumer’s credit report! This was announced by all three CEO’s of Equifax, Experian and TransUnion in April of 2022. Now before we start patting these CEO’s […]

Whether you are applying for a new credit card or a home loan, hard inquiries are constantly present when attempting to build credit. Although hard inquires are one of the most common items found on a credit report, there is still much mystery surrounding their effect on a credit score. In todays “Fact or Fiction” […]

Whether you are applying for a new credit card or a home loan, hard inquiries are constantly present when attempting to build credit. Although hard inquires are one of the most common items found on a credit report, there is still much mystery surrounding their effect on a credit score. In todays “Fact or […]