How Do Inquiries Impact My Score? One of the common misconceptions about a credit score is that inquiries have a major role in the score. If you have looked at your credit score recently and feel that there are not many dings to the report that would cause your score to be low, take a […]

Tag Archives: FICO

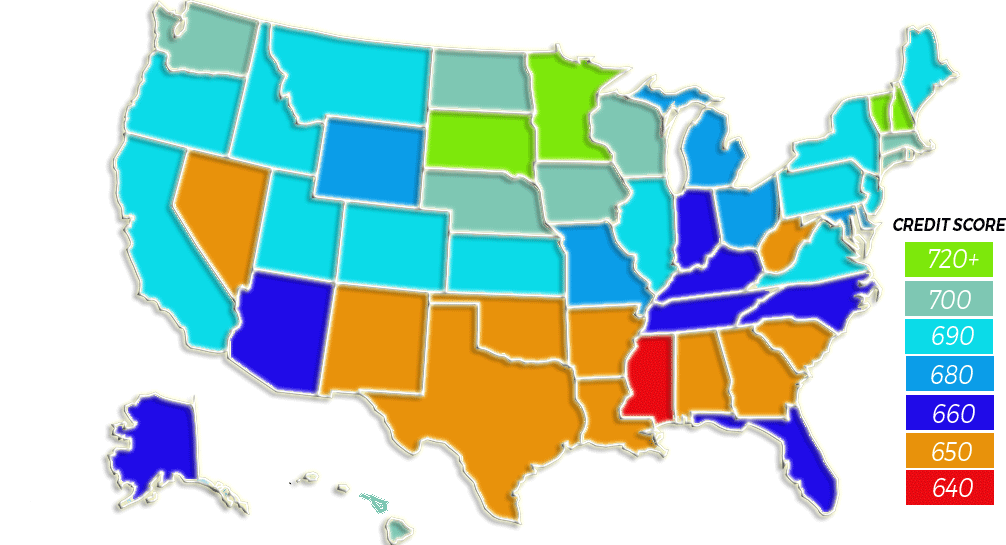

A Record-Breaking Year We have seen the highest average credit score ever in 2019 and the numbers keep rising! The U.S. economy is truly booming: Record job growth caused unemployment rates to drop to a record low and the stock market flourished throughout the year. Consumers showed their confidence as they continued to […]

We Broke the Record! In 2019 the average credit score was recorded as being a 703 among Americans and it’s time to get excited! We have broken our record with an average increase of 25 points since 2012 and with the right credit knowledge and repair options, we are sure to continue our climb! A […]

In recent weeks the United States has been hit with several natural disasters, leaving Americans uprooted from their homes and their employment. Texas and Florida are dealing with the aftermath of flood and rain waters from Hurricane Harvey and Hurricane Irma, while the Western United States is dealing with the complete opposite dry and extreme […]

How Do Inquiries Impact My Score? One of the common misconceptions about a credit score is that inquiries have a major role in the score. If you have looked at your credit score recently and feel that there are not many dings to the report that would cause your score to be low, take a […]

Student Loans and Credit Scores Student loans seem to be on almost everyone’s credit reports. They can positively impact your credit scores if you are consistent with your payments and aware of what is happening with your loan. As with any bill or loan you take out, it is extremely important to your credit score […]

How Your Score Is Costing You Thousands Back when I graduated high school (a few years after dinosaurs walked the earth) I had absolutely no idea how detrimental my credit score would be to my future purchases. My brother was sitting pretty with a 750 credit score and financed his new car at an extremely […]

In recent weeks the United States has been hit with several natural disasters, leaving Americans uprooted from their homes and their employment. Texas and Florida are dealing with the aftermath of flood and rain waters from Hurricane Harvey and Hurricane Irma, while the Western United States is dealing with the complete opposite dry and extreme […]

Establishing good credit in this day and age plays a significant role in becoming financially secure. However, there are still 26 million Americans that are still “credit invisible” under the traditional FICO scoring model.If you are one of the 26 million Americans that are “credit invisible” you may already know the challenges that this credit […]

If you are one of the 12 million consumers that have derogatory tax liens or civil judgments on your credit report you may see a score increase after these critical items are removed. As of July 1, the three major credit reporting agencies, Equifax, Experian, and Transunion, will be removing the derogatory information on credit […]