Increased Credit Scores by 100 Points

At Credit Law Center we love hearing success stories from past clients. One client shares how Credit Law Center helped her family save money and increase their scores.

What brought you to Credit Law Center?

I was online one day and was looking at homes. A lender reached out to me and we started talking about purchasing a home. She pulled my credit scores and we had some past debt that we needed taken care of. I know credit is important. Based off the information we gave the lender, she gave us some options to get where we needed to get approved. She referred us to one of her Credit Advisors at Credit Law Center and so we got in touch. They assured us that we would only pay for the items that actually got deleted and our advisor talked us through the process and the costs.

How did you feel about working with a Credit Repair Company?

I was a little skeptical at first, but I looked into it. I had a really good feeling about my lender referring me to Credit Law Center. My credit advisor, Kim was really good at getting in touch with me. She let me know if an item was not removed, you didn’t pay for it. I let her know I was going to be out of town on a trip and what I could afford. She made it very inexpensive and worked with me on my budget. I signed all the paperwork and got my report pulled. She went over everything with me, past debts, and gave me advice on the credit I did have. I hadn’t made my first payment yet, and I saw my scores were already jumping and that was back in January. I was receiving updates every month and my scores just kept jumping. My score has improved 100 points since we started the process.

What has the change in credit scores done for you?

The good thing is, back in December I had just got a vehicle. Then in February my husband and I went to get a vehicle for him. My scores had increased so much, my interest dropped 10% from when I got my vehicle back in December. It has just been awesome!

Are you purchasing a home now?

Yes, we qualified and based off the information and our credit jumping, we are able to move forward in the loan process. I have told family about; it was definitely worth it! That’s the good thing with Credit Law Center, any time anything touched my credit they were monitoring it. I was always getting updated and any questions I had to ask, I was able to reach out to my advisor and could count on her.

Credit Law Center has been awesome and I am happy my lender put me in touch with them. One thing I can say, my husband was very skeptical but after seeing me go through this process with Credit Law Center my husband now wants to go through the repair process and he doesn’t have a bad taste about credit repair anymore.

Do you have questions about your credit report? If you would like to speak with one of our attorneys or credit advisors and go through a free consultation please give us a call at 1-800-994-3070 we would be happy to help.

If you are hoping to dispute and work on your credit report on your own, here is a link that provides you with a few ideas on how to go about DIY Credit Repair.

A Note From The Author: The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.

Article by Breana Washington

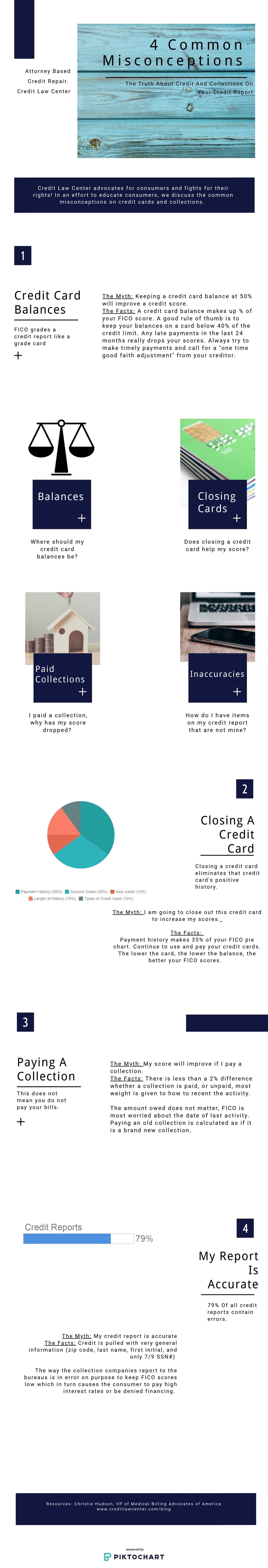

Check out Credit Law Center’s info-graphic on 4 myths of collections reporting on credit reports.