With social media so present in our lives now we see the amount of GoFundMe pages for medical bills, it is validating the statistics. According to a recent report, by the CFPB 43 million Americans have overdue medical debt on their credit reports. Approximately 2 million Americans are affected annually by medical debt and remains the leading […]

Category Archives: Credit Repair Blogs

From the day we bring home our children from the hospital all we want to be the best at guiding them and teaching them. It’s a no brainer we will be the one teaching them to tie their shoes, brush their teeth, and most of us will be that one parent waiting up for them […]

The IRS just made it harder to tell if you are getting scammed. Prior to April of 2017, getting a call from someone claiming you owed money to the IRS, you could have bet on it being a scam. As of April 2017 the IRS began using private debt collectors to collect on certain overdue […]

A Single parent balances work, children and finances daily, this doesn’t stop most single parent households from the desire to purchase a home. Home ownership to many single parent families represents the ability to achieve self-sufficiency and economic independence, to other single parent households it is a way to provide a stable, engaged environment for their children. […]

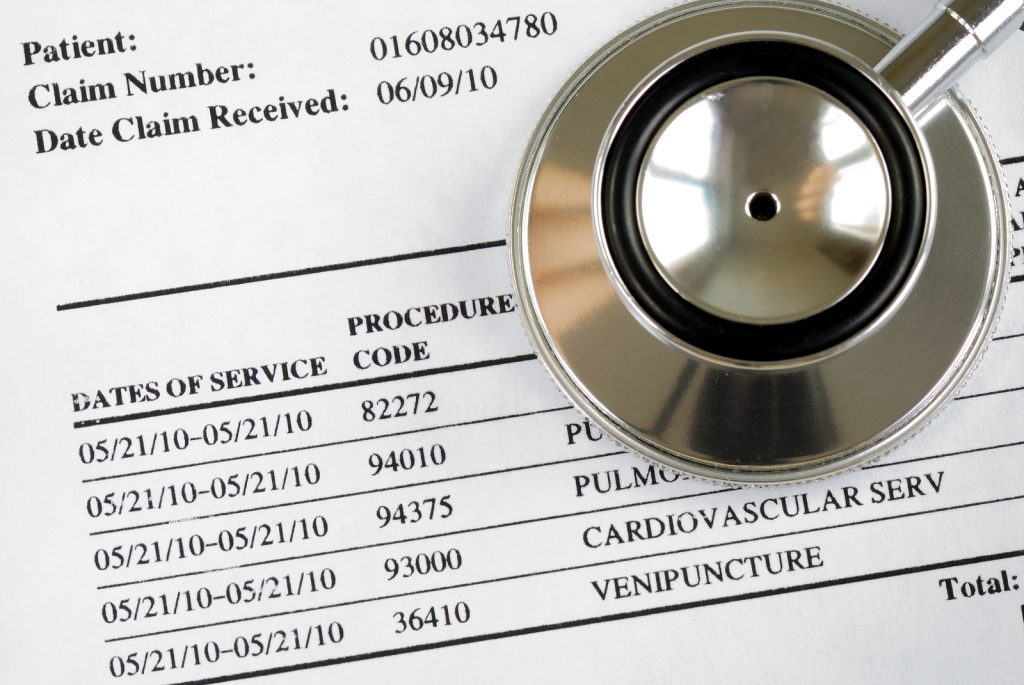

31 percent of Credit reports contain collection items, 67 percent of these collections are medical collections. Medical debt is often incurred as a result of an unexpected injury or illness, and a majority of medical debt happens to patients who are covered by insurance. Medical Debts turning in to a Collection The doctor’s office or hospital will handle the […]

What makes up your FICO score and how is it calculated? A FICO score is a 3 digit code measured by pulling data from all three credit reports, Experian, Transunion, and Equifax, it is then used to determine your credit risk to lenders. The information pulled is put in to a FICO Score Formula, as […]

Are Debt Collectors or Debt Buyers Calling you? – Credit Law Center Do you immediately send an unknown call to voice mail, knowing it is just another abusive debt collector? Debt collectors and debt buyers spend lots of time and money going to seminars and workshops to stay up to date on all the rules and regulations. […]

Are free credit scores a waste of your time? Last week, 2 of the big 3 credit bureaus were ordered to pay $23 million for deceiving customers. The CFPB accused the credit bureaus of misleading marketing of false information of credit scores and products being sold to the public. According to the regulator, “TransUnion and Equifax […]