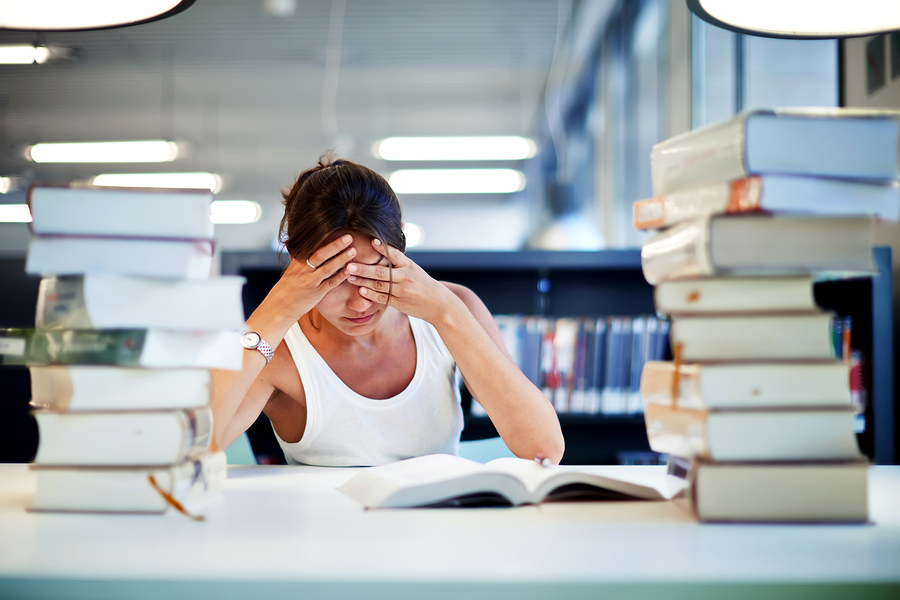

How Could You Be Hurting Your Credit? The more you know about how credit works, the better your score will be. This is because, without a lot of background knowledge, your own logic and reasoning will oftentimes fail you. There are a lot of factors that go into creating your credit score, so trying to […]

Tag Archives: payments

How Could You Be Hurting Your Credit? The more you know about how credit works, the better your score will be. This is because, without a lot of background knowledge, your own logic and reasoning will oftentimes fail you. There are a lot of factors that go into creating your credit score, so trying to […]

Now that the new year is upon us, it is time to start on our resolutions for the year. My group of friends all discussed what we want to work on this year to better ourselves and the lives we live. A couple of us are looking to hit the gym more frequently while Eric […]