The simple answer according to FICO is 715. But average means different things when it comes to one’s age, where they live, and how much money they make. There are also so many scoring models out there, it’s hard to tell where one stands. One thing for certain is getting yourself in a position to […]

Category Archives: Credit Score

How long does it take actually to take for the credit repair process? There seems to be no definite answer on the time frame for how long the credit repair process takes. If you google it, you will see there is not a standard amount of time and no straightforward answer. Unfortunately what happens most […]

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]

By now, many of you may have heard the buzz phrase “Credit Crunch.” This has been reported in the last few weeks on most all media outlets. Just the sound of that phrase is frightening in today’s economic environment. Interest rates are up, the cost of goods and services have risen, and many may see […]

Building Buying Power As the Spring months start peeking through, the home buying market is heating up! Have you been picturing the day when you can paint your own walls and mow your own grass? The dream of homeownership comes with great financial responsibility. Many first-time home buyers have questions about their down payment, and […]

What is a credit score? Most people would answer that this is how lenders see if you are able to receive a loan and at what interest rate. And that’s true. But really, it’s an algorithmic number telling a lender how likely a person is to default on a loan within the first 24 months. […]

Most all of us have heard of Debt consolidation. But is Debt Consolidation right for you? What type of debt consolidation should one choose? Is Debt Consolidation effective? What are some of the pitfalls of debt consolidation? Guess what, sometimes “life” happens and we need to utilize our credit cards out of necessity. A perfect […]

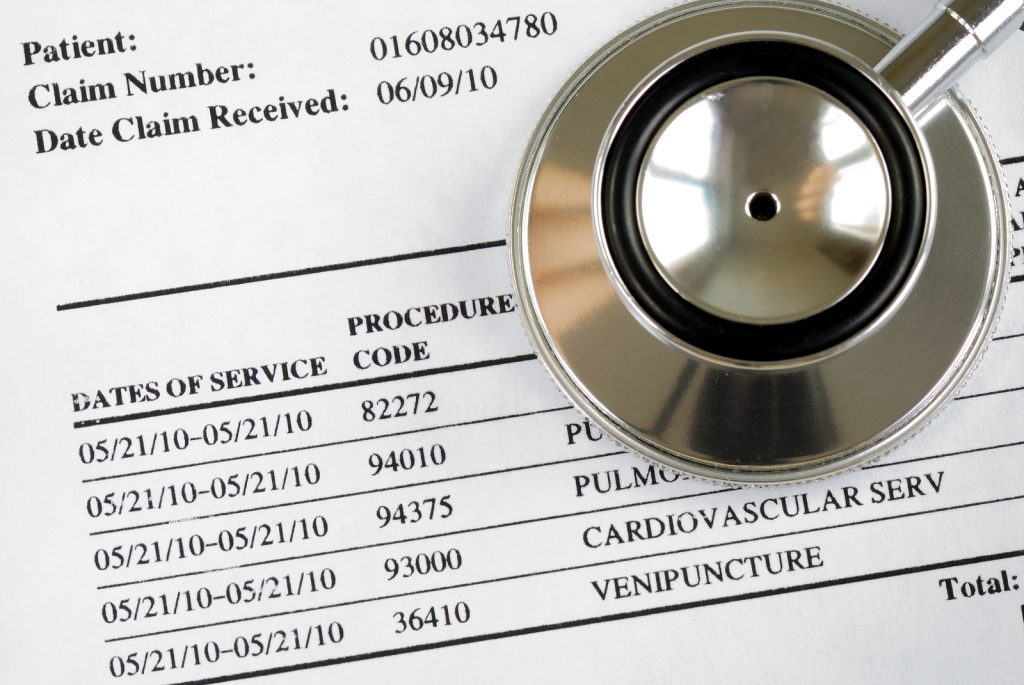

As of July 1st, 2022 all medical debts that have been paid, whether the debt was held by a physician or a collection agency, must be suppressed from a consumer’s credit report! This was announced by all three CEO’s of Equifax, Experian and TransUnion in April of 2022. Now before we start patting these CEO’s […]

Does unemployment affect my credit? Unfortunately job loss is something many American’s experience in their lifetime. The loss of a job means financial hardships, which directly affects our consumer’s credit. Here is what you need to know about how job loss can affect your credit scores. Loss of Savings: Money that was saved for emergency […]

Time to Pass Go: How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is going to […]