On July 31st, 2023 a bi-partisan group of Congressional Representatives wrote to the Director of the Federal Housing Finance Agency, in essence, demanding that the FHFA keeps their deadline in the implementation of VantageScore 4.0 and FICO 10T for determining credit scoring factors in gaining a Home Mortgage Loan. FICO has been the standard bearer […]

Category Archives: Credit Score

Time to Pass Go: How to Establish a Good Credit Score Whether it’s finding a home for your growing family, financing your dream car, entering a career or even attempting to acquire a decent rate on car insurance, everything in our lives revolves around credit. No matter what you do, someone is going to […]

To piggyback on our last blog, a statement from the National Consumer Reporting Association (NCRA) sounded the alarm of sharp price increases for purchasing credit reports. The surprising fact to me is the vast discrepancies in who is charged and at what percentage the charges will increase. The NCRA stated, “the vast majority of mortgage […]

The simple answer according to FICO is 715. But average means different things when it comes to one’s age, where they live, and how much money they make. There are also so many scoring models out there, it’s hard to tell where one stands. One thing for certain is getting yourself in a position to […]

Good, Better, Best and Bad The internet and cell phones have now made it easier than ever to check your credit score as often as you’d like. Millennials are starting to check their credit scores more frequently than any other generation. This could be due to the fact that credit has become vital in many […]

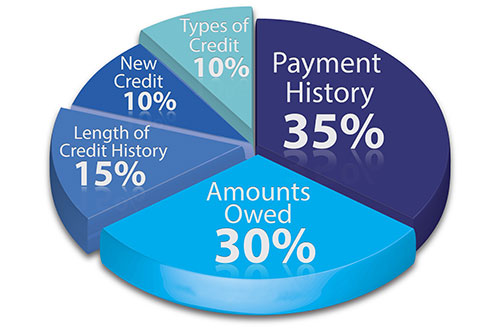

How Could You Be Hurting Your Credit? The more you know about how credit works, the better your score will be. This is because, without a lot of background knowledge, your own logic and reasoning will oftentimes fail you. There are a lot of factors that go into creating your credit score, so trying to […]

There are so many things that come into play to obtain a healthy credit profile. The hardest part of navigating the credit world however, is knowing what advice is accurate and possibly stumbling a few times in an effort to get back on track. Many times consumers think they have a good grasp on it […]

I have clients from all over the country asking me how much particular items on their credit report are affecting their credit and if the item is removed, then will their credit score rise. It is difficult to provide a precise answer because there are many underlying factors that can make or break your credit! […]

So, what are the steps to take in order to know you will be approved for a credit card. There are so many types of credit cards available, what type of card should you realistically expect to attain. There are commercials daily soliciting the “Reward” credit cards. Those sound appealing. Are they right for you? […]

I Want To Buy, Now! Are you preparing to purchase a home in the next few months? It seems that when we are not looking, a home just pops up and finds us, at a time when we were not even contemplating making a move. Then, boom! The rush is on to beat the clock […]