3. Are you lacking excess funds?

Although there are several programs in place for borrowers with little to no money down, it is a good idea to save and have some skin in the game for a down payment. Many lenders would prefer to work with someone that has shown financial responsibility and saved and set aside money. A lender may be hesitant if you do not, and potentially feel like you still may be a risk.

4. Are you avoiding other responsibilities you have?

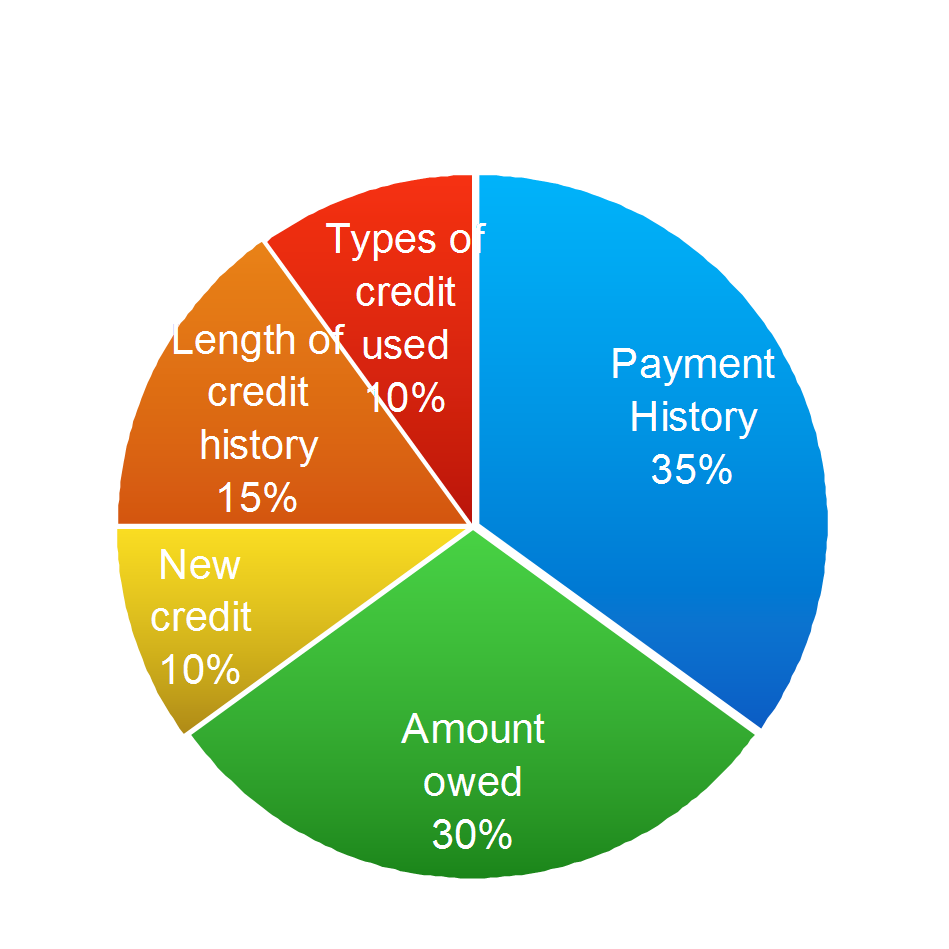

Late payments impact your credit score the greatest. If a lender sees you have been falling behind on responsibilities you already have, this can be a large red flag during this process. Again, they are considering the likelihood of you to fall behind on the loan, and if you are late on several bills, why would they feel your mortgage would be any different?

If the above apply to you, and you are potentially a high risk borrower, do not let that stop you from pursing a home. As discouraging as things might seem, there is hope for you after some time of getting back on track.

If your credit is not where it should be and your lender has expressed concern, you may look into a few different options within credit repair. If you are in a rush and are pressed for time, Credit Law Center can help you through a quick and affordable process. Each round with Credit Law Center lasts 30-45 days. If you have items on the credit report that have to be removed (collections, tax liens, bankruptcy, etc) allow a credit advisor to walk you through a consultation.

The credit advisors at Credit Law Center will let you know what you can work on, on your end as well as what you may be doing that is keeping you from higher credit scores. With a little help and a guide to walk with you, that new home may be closer than you expected.

A Note From The Author: The opinions you read here come from our editorial team. Our content is accurate to the best of our knowledge when we initially post it.

Article by Breana Washington