The passing of a loved one comes with many daunting tasks and an overwhelming amount of emotion. One task you may overlook is reporting their death to the three credit reporting agencies, Equifax, Transunion, and Experian. When a loved one passes, the Social Security Administration will eventually get around to notifying the credit bureaus. However, […]

Category Archives: Credit Repair Blogs

A significant factor in the credit repair process is determining if you are ready to commit to the lifestyle changes that are required to make it successful. Becoming creditworthy doesn’t happen overnight, and there is no magic formula to increase immediately. Each credit scoring model comes with its unique algorithm that will vary depending on […]

For most Americans, a mortgage payment is their largest monthly obligation. Traditional lenders suggest that your monthly mortgage obligation is not over 28% of your gross income. Unfortunately, life happens to some of us; we lose a job, car accidents, illness or any other event that may cause havoc to our finances. If you have […]

People influence people. A trusted referral influences people more than the best broadcast message. A trusted referral is the Holy Grail of advertising. – Mark Zuckerberg, Founder, and CEO, Facebook Referral Partners are the block too many different industries success stories, therefore making sure you have a strong foundation and great products to offer is […]

We all know good credit is an important aspect of our financial life and is a must to purchase a home, car, and it even affects our car insurance. The first thing you need to know is the common misconceptions, the “credit myths.” Being aware of the top 5 credit myths, and knowing the facts […]

Memorial Day is the day we honor those men and women who took the ultimate sacrifice and in return giving us the greatest gift as United States Citizens, FREEDOM!What a great honor to live in this Country and to be given this wonderful gift, here at Credit Law Center we want to express our heartfelt […]

Wow! With the cost of rent rising have you ever thought about buying a home? It is important to weigh the pros and cons of renting vs buying. Credit scores are a factor in buying a home, but there are many different programs for future home buyers can help them get approved for a loan. According to a recent report by Zumper National […]

A divorce decree is the final courts ruling or judgment in the termination of marriage. In this final judgment, the two parties will divide properties, determine spousal/child support and divide financial debt. Something that is brought up a lot in regards to credit reports and debt collections is, my spouse was supposed to pay that […]

If you want to purchase a home the best possible way to guarantee you are on the right track is to see a mortgage lender. A lender will be able to help you in the pre-approval process. The pre-approval is a promise from the bank that you are qualified to borrow up to a certain amount at […]

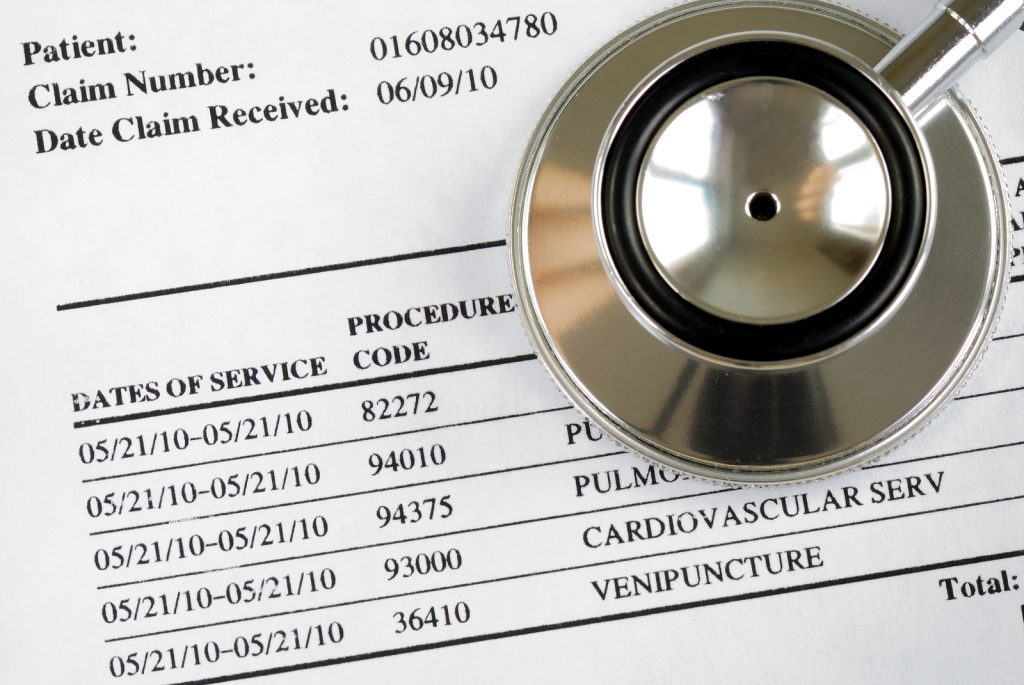

With social media so present in our lives now we see the amount of GoFundMe pages for medical bills, it is validating the statistics. According to a recent report, by the CFPB 43 million Americans have overdue medical debt on their credit reports. Approximately 2 million Americans are affected annually by medical debt and remains the leading […]